New EV entries nibbling away at Tesla EV share

This post was released by S&P Global Mobility and not by S&P Global Ratings, which is an individually handled department of S&P Global.

U.S. electric automobile registrations stay controlled by

Tesla, the brand name is showing the anticipated indications of shedding market

share as more entrants show up. Much of Teslas share loss is to EVs

readily available in a more available MSRP range – listed below $50,000, where

Tesla does not yet genuinely compete.Regardless of brand or cost point, early S&P Global

Mobility data recommends consumers moving to electric cars in

2022 are mostly doing so from Toyota and Honda – brand names which have

been not able to keep their internal combustion owners devoted until

their own brands begin to participate more considerably in the EV

transition.While both Japanese business built an US legacy with phenomenal

fuel economy and powertrain technologies – including

electrification through hybrids, plug-in hybrids and fuel-cell

electrical lorries – both have actually been captured flat-footed in the

context of 2022. S&P Global Mobility conquest information for Teslas.

Model 3 and Y, Ford Mustang Mach-E, Hyundai Ioniq5, and Chevrolet.

Bolt show strong captures of buyers from the 2 leading Japanese.

brands.Teslas challengeSo far, the majority of EVs continue to be obtained for higher MSRPs and by.

buyers with greater incomes than the market profile for total.

light lorry registrations– in part due to the fact that many EVs are.

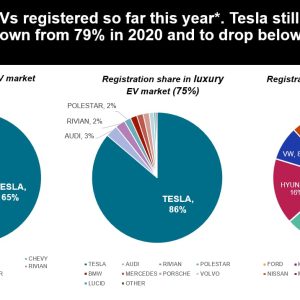

Teslas.Of more than 525,000 EVs registered over the very first 9 months.

of 2022, nearly 340,000 were Teslas. The remaining volume is.

divided, very unevenly, among 46 other nameplates. The.

trends might change as the variety of EV purchasers ends up being more.

robust.Teslas position is changing as brand-new, more affordable options.

show up, offering equivalent or much better technology and production develop.

Provided that customer choice and consumer interest in EVs are.

growing, Teslas ability to maintain a dominant market share will be.

challenged going forward.S&& P Global Mobility forecasts the number of battery-electric.

nameplates will grow from 48 at present to 159 by the end of 2025,.

at a pace faster than Tesla will be able to add factories. Teslas.

CEO Elon Musk validated (again) during a recent profits call that.

the company is dealing with an automobile priced lower than the Model 3,.

though market launch timing is unclear.Teslas model range is anticipated to grow to consist of Cybertruck in.

2023 and ultimately a Roadster, however mostly the Tesla design lineup.

in 2025 will be the very same designs it offers today. (Tesla is likewise.

Planning to provide a commercial semi-truck by the end of 2022.

it would not be factored into light-vehicle registrations.)” Before you feel too badly for Tesla, however, keep in mind that the.

brand name will continue to see system sales grow, even as share.

declines,” said Stephanie Brinley, associate director,.

AutoIntelligence for S&P Global Mobility. “The EV market in.

2022 is a Tesla market, and it will continue to be, so long as its.

rivals are bound by production capacity.” Tesla has actually opened 2 new assembly plants in 2022 and is looking.

for the website of its next North American plant. Tesla today is the.

brand best equipped for making the most of the immediate rise in.

EV demand, though manufacturing financial investments from other automakers.

will erode this advantage earlier than later.The competitionThroughout 2022, EVs have actually gained market share and customer.

attention. In an environment where vehicle sales are restricted by.

inventory and availability, EVs have actually acquired 2.4 points of market.

share year over year in registration information compiled through.

September – reaching 5.2% of all light car registrations -.

according to S&P Global Mobility data.The nascent stage of market growth leaves others completing for.

volume at the lower end of the price spectrum. New EVs from.

Hyundai, Kia and Volkswagen have actually signed up with Fords Mustang Mach-E,.

Chevrolet Bolt (EV and EUV) and Nissan Leaf popular brand.

area. High-end EVs from Mercedes-Benz, BMW, Audi,.

Polestar, Lucid, and Rivian – as well as big-ticket products like the.

Ford F-150 Lightning, GMC Hummer, and Chevrolet Silverado EV – will.

plague Tesla at the high-end of the market.With the Model Y and Model 3 combined taking 56% of EV.

registrations, the other 46 vehicles are completing for scraps up until.

EVs cross the chasm into mainstream appeal. (A recent S&P.

Global Mobility analysis revealed the Heartland.

states have yet to embrace electric lorries.)” Evaluating EV market performance needs browsing a.

lower-volume lens than with standard ICE products,” Brinley.

said. “But growth potential customers for EV items are strong, investment.

is enormous and the regulatory environment in the US and globally.

suggests that these are the option for the future.” Production volumes today are restricted by factory capability, the.

semiconductor shortage and other supply chain challenges, too.

as consumer need. The problem of production capacity is being.

attended to, as automakers, battery makers and providers put.

billions into that side of the formula. There are lots of.

signals suggesting customer need is high which more buyers may.

want to make the transition – and to do so faster than.

expected even a year ago.But customer desire to develop to electrification remains.

the largest wildcard. Looking past Model Y and Model 3, no single.

model has achieved registrations above 30,000 units through the.

Three quarters of 2022. The second-best-selling EV brand name in.

the US is Ford. Mach-E registrations of about 27,800 systems.

have to do with 8% of the volume Tesla has recorded, according to S&P.

Worldwide Mobility data.Tesla has four of the top five EV designs by registration; in the.

sixth through 10th positions are the Chevrolet Bolt and Bolt EUV,.

Hyundai Ioniq5, Kia EV6, Volkswagen ID.4 and Nissan Leaf. Through.

September, the Bolt has seen about 21,600 lorries signed up,.

Hyundai and Kia are in the 17,000-18,000- system variety, and VW.

approached 11,000 units. Consisting of the tenth-place Leaf, no other.

EV has actually had registrations above 10,000 systems over the very first nine.

months of 2022. That stated, there are caveats. Volkswagens low volumes are.

affected by supply chain snarls and market allotments to more.

EV-friendly regions – issues Hyundai and Kia also deal with. However,.

VWs new ID.4 assembly line in Tennessee went live in October; the.

car manufacturer stated at the plant opening that it had 20,000 unfilled.

bookings and a plant capability of 7,000 systems per month.That ought to alter the EV volume photo substantially. A look.

at the approximately 525,000 EVs signed up over the very first nine months of.

2022 reveals the EV market today remains in the hands of wealthy.

buyers, who are investing more on their vehicles than ICE.

buyers.While reasoning determines that more growth will require more EVs.

being used in the $25,000-$ 40,000 price variety, the willingness.

of purchasers to spend more today reflects an aspirational nature to.

the choice.Teslas EV-only technique provides it a retention advantage – as couple of.

EV owners have actually gone back to ICE powertrains. As brand-new EVs get here,.

commitment will be tested. Presently, the Model Y has a 60.5% -brand.

loyalty and had nearly 74% of buyers originated from outside the brand.

( the conquest rate) – tops in the industry. Who is Tesla.

conquesting from? Toyota, Honda, BMW and Mercedes-Benz. Toyota and.

Honda are just starting to get into the EV market, though have.

to enter the fray in earnest.The race to marketHonda owners in specific are showing an interest in electric.

lorries. For Honda, its very first EV (a midsize SUV.

shown GM) isnt anticipated till 2024, whereupon the 2nd.

half of this years sees a flurry of activity. That still provides.

the difficulty of reconnecting with owners who have defected from.

the Honda brand.In its meteoric development, Tesla has conquested Japanese icons: The.

leading 5 Model Y conquests are the Lexus RX, Honda CR-V, Toyota.

RAV4, Honda Odyssey, and Honda Accord. On the other hand, the top five.

Design 3 conquests are the Honda Civic, Honda Accord, Toyota Camry,.

Toyota RAV4 and Honda CR-V. So even though the general market has.

dumped sedans for SUVs, there stay some who choose a sedan in.

electrified form.But its not just Tesla winning over consumers of the huge 2.

Japanese brands. Early data of the 27,800 registrations of the Ford.

Mustang Mach-E through September, shows similar conquest patterns:.

The top Mach-E conquest model has actually been the Toyota RAV4 (regardless.

of powertrain), followed by the Honda CR-V and Jeep Wrangler. The.

Mach-E is also experiencing registrations at a lower MSRP range -.

43% of registrations had an MSRP below $50,000. For Ford, more than.

63% of registrations from January through September 2022 were.

conquests from other brands.After the Mustang Mach-E, the next leading EV is the Chevrolet Bolt.

( EUV and EV). The Bolt is most likely to continue to gain ground, as it.

spent the majority of the fall and winter season of 2021-22 in production hiatus.

as Chevrolet solved a guarantee concern, and then saw a cost.

reduction quickly after production re-started. With production back.

online, a more appealing price, and GMs strategies to increase Bolt.

capacity in 2023, the lorry has prospective to keep growing. The.

Bolt likewise sees RAV4, CR-V and Prius as its top three conquest.

models.And while the Hyundai Ioniq5 is restricted in its geographic.

circulation (and deals with comparable capability and international need issues.

as VW ID.4), S&P Global Mobility conquest data reveal most Ioniq5.

purchasers formerly owned a Toyota RAV4, Honda CR-V, Mazda CX-5 or.

Subaru Forester. Of the top 10 Ioniq5 conquests, only 2 are from.

the conventional Detroit Three brands, with the Chevrolet Bolt at.

seventh and Jeep Wrangler at tenth.Of course, the high conquest rates from Toyota and Honda come.

from the historic sales success of those designs overall. The RAV4.

is the very popular non-pickup truck in the US, which suggests there.

are more RAV4 purchasers to conquest. The Camry, Accord, and CR-V.

follow close behind.Along this path, nevertheless, these EVs are seeing little conquest.

of the F-Series or Chevrolet Silverado pickup. In the S&P.

Worldwide Mobility garage mate data, nevertheless, we see a strong F-Series.

representation. It appears as a top garage mate for the Mustang.

Mach-E; the Bolt does see the Silverado as its top garage mate, the.

F-Series is next. F-Series is likewise the top garage mate for the.

EV6, ioniq5 and id.4.” Though todays EV purchasers are not quiting their pickups in.

favor of going electric, it likewise suggests that there is a pool of.

EV owners, who are also full-size pickup owners, being produced,”.

Brinley said. “We understand that EV owners tend to be devoted to EV.

propulsion. This crossway can provide assistance for EV pickup.

adoption.” An existing swimming pool of present EV owners who also have pickups can.

be an advantage for the efforts in the full-size EV pick-up area,.

especially for the Ford F-150 Lightning, Chevrolet Silverado EV.

and GMC Sierra EV, each of which is targeted at a traditional pick-up.

use case and owner. The Rivian S1T, GMC Hummer EV and Tesla.

Cybertruck each inhabit a way of life pickup space, tailored toward.

innovator purchasers and statement-makers, and might be more likely to.

conquest buyers to the pickup segment as well as to an EV purchase.

But for now, electric vehicles stay the provenance of sedans and.

small SUVs.NOTE: All commitment data is based on the S&P Global.

Mobility home commitment approach, which may show an.

addition to the garage and not always a disposal.Please contact automotive@spglobal.com to discover out more.

info around our insights to assist you make data-driven.

decisions with conviction.

That said, there are caveats. Volkswagens low volumes are.

Toyota, Honda, BMW and Mercedes-Benz. Toyota and.

Leave a reply