Fuel for Thought: The future of EVs and alternative propulsion in the commercial vehicle market

Automotive Monthly Newsletter &&

. Podcast: LISTEN TO THIS.

PODCASTAside from the supply shortage, one of the most significant buzzwords in.

the commercial car industry over the previous few years has.

focused on electrical cars (EVs). Everybody has a viewpoint on.

whether EVs are a trend or here to remain but what does the data say.

particularly about EVs in the industrial industry? Even through the.

supply concerns of the previous few years, there were more EVs registered.

commercially through August 2022 than all of 2021. Given that 2015, 53% of brand-new United States EV registrations have been Tesla.

When we eliminate Tesla and specifically look at fleets,.

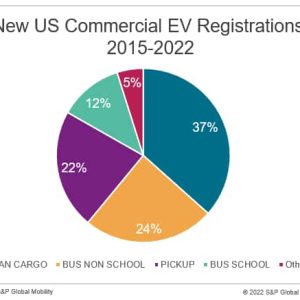

cargo vans make up 37% of EV registrations and are being registered.

to companies such as Amazon, Walmart, and FedEx. All these.

companies have actually developed collaborations with Rivian, Ford, and.

Brightdrop, respectively, with financial investment or order commitments.

Last-mile shipment is a terrific suitable for EVs owing to the hub and.

spoke nature of delivery. These cars are not traveling long.

ranges and can go back to the exact same center to charge every night.

These registrations are occurring mostly in states such as.

Florida, California, Arkansas, and Illinois. California is leading.

the way for EV development through schedule of more aids and a.

much better charging ecosystem. Illinois is likewise using extra.

incentives. In states such as Florida and Arkansas, a large.

concentration of lorries have actually been registered by Amazon and.

Walmart.Another sector of the business vehicle population that is.

gaining from EVs is buses. Buses are nipping at the heels of.

cargo vans, currently comprising 36% of EV registrations. Similar to.

cargo vans, buses can return to the same hub every night to charge.

and are taking a trip distances that fit in the present EV battery.

range. School buses in specific travel a recognized path in the.

morning, have hours of downtime that can be utilized to charge, then.

understood routes in the afternoon. Recently, Canada announced 100%.

zero-emission trucks and buses by 2040 and USD550 million was.

earmarked for those incentives. These incentives offer up to.

USD200,000 off of the purchase of certain trucks and buses. In the.

United States, the Infrastructure Investments & & Jobs Act (IIJA).

boosts significantly the funds available to transit buses and charging.

infrastructure to USD5.5 billion. Washington DC, California, and.

New York are ending up being locations for both school buses and.

non-school buses. In this category, Lion Electric, New Flyer, Blue.

Bird, Proterra, and Freightliner are introducing new EV models.In addition to cargo vans and buses, there is likewise news associated.

to Class 8 electrical trucks. Tesla stated that in December it would.

deliver to PepsiCo the very first of a 100-unit order of the Tesla Semi.

These BEV trucks will likely certify for a USD40,000 incentive.

through the Inflation Reduction Act just recently signed into law. Tesla.

joins more traditional Class 8 truck contractors such as Daimler,.

Volvo, and Traton in providing EV semis. Tesla is not the only.

newbie to electrification. Though Tesla and Rivian are the 2.

most recognizable disruptors in the business vehicle market, they.

are not alone. EV startup companies have actually concentrated on the commercial.

lorry segment as a releasing pad for brand-new energized items.

Cargo vans, buses, and Class 8 semis are the items of option,.

followed by pickups and insufficient chassis. The driving factor.

behind these product choices is certainly the considerable growth.

in e-commerce that began prior to the COVID-19 pandemic and.

sped up to even faster growth throughout and following the.

pandemic. Online ordering of items has considerably increased the.

demand for cargo vehicles for last-mile delivery, along with.

interstate transport.Alongside shipment vans and buses, the commercial car.

industry also includes Class 4-8 medium and heavy trucks. Utilized for.

carrying goods, in their own right, or for pulling trailers, these.

automobiles are usually above the gross car weight ranking (GVWR).

of most production vans. Although registrations of zero-emission.

automobiles (ZEVs) in this part of the market are still extremely low,.

the pace of adoption in the present decade is set to speed up. By.

2030, as much as 17% of the new truck market is anticipated to be.

ZEVs. 4 main reasons for the expected ramp-up are product.

schedule, OEM methods, policy, and the expected.

development of the price-cost relationship.The definition of a ZEV might vary and is anchored in local.

regulation. Generally, ZEVs include pure battery-electric trucks,.

As fuel-cell electric vehicles (FCEVs). Some jurisdictions.

may also group some hybrid electric vehicles (HEVs) with these.

main ZEV types. Some ZEVs are produced each year by converters,.

which start with an existing OE chassis. More just recently, the OEMs.

themselves have actually begun to provide devoted ZEVs to the marketplace.

straight. Whereas brand-new registrations of Class 4-8 OEM-installed.

systems in the US ended up at fewer than 100 units in 2021, brand-new.

registrations of OEM-produced ZEV trucks in 2022 approached double.

that in the first 8 months alone. Compared to 4 brands.

with ZEV items tracked by S&P Global Mobilitys brand-new.

registrations statistics in 2021, 7 brand names recorded new.

registrations of ZEV trucks in year-to-date (YTD) 2022. In the United States, all the top OEMs are openly traded. The.

evident broadening in the ZEV truck product rollout is by design.

and aimed to assist the OEMs reach their environment goals, as.

communicated to investors. Diverse options are available where.

ZEV options make the most relative sense. These variety from.

stepvans at the bottom end of the weight variety to bigger, two-axle.

box vans in the middle and daycab tractor trucks at the upper.

end.Manufacturer environment ambitions correspond with encouragement by.

regulators and improvements in technical services. For their part,.

regulators in the United States have actually been especially active at the.

private state level, where California blazes a trail in setting.

ZEV adoption requireds and prepare for public-sector assistance. Nevertheless,.

California is not alone, and 15 other states and jurisdictions have.

revealed strategies to imitate Californias goals and approach.

Producers are to fulfill goals stepwise, with gradual progress to.

the end objective each year. Together, these jurisdictions have the.

potential to promote critical mass in US ZEV volume by the early.

part of the next decade.ZEV offerings in the market today are, in a lot of cases, well above.

the purchase rates of comparable diesel- or gasoline-powered.

vehicles. Improvements in manufacturing, automobile style, and.

adoption will help in reducing costs incrementally gradually. Financial.

support for producers and truck users might help to further grow ZEV.

demand. Just how much support in the type of public cash and other.

resources required will depend, in part, on the state of the ZEV.

technologies themselves and, in specific, their expense and.

suitability in various trucking vocations. While some occupations,.

such as long-haul trucking, may be extremely challenging for ZEV trucks.

even in the long term, others could see expense of ownership parity.

approach more rapidly, for example, stepvans used for parcel.

delivery. S&P Global Mobility takes a look at these and associated problems.

in our upcoming report Reinventing the Truck 2022,.

produced in combination with our Commodity Insights team. —————————————– Dive Deeper– Check out our vehicle.

insightsIdentify your finest prospects with.

fleet information from all non-restricted states|Discover MoreHow quickly will truck.

manufacturers transform to alternative propulsion? Download a.

SampleFind out more about our commercial.

lorry special studies|Discover MoreReinventing the Truck – 30-year.

outlook|Find out more.

Mark Hazel, Associate Director, Product Management– Commercial Vehicle Reporting, S&P Global Mobility.

James Martin, Consulting Associate Director, Automotive Advisory, S&P Global Mobility.

Posted 25 October 2022 by Andrej Divis, Executive Director, Global Truck Research, S&P Global Mobility.

and.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is an independently handled department of S&P Global.

and.

Leave a reply