February 2023 US auto sales holding the line

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is an individually managed division of S&P Global.

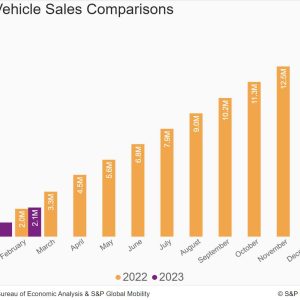

February 2023 car sales are expected to advance slightly from

the month-prior level, however not nearly enough motion to recognize

any change to present need dynamics.With US light car sales volume for the month forecasted at

1.1 million units, we expect February 2023 to represent

year-over-year (y/y) growth of 5%, the seventh consecutive month of

y/y volume enhancement. The tally would also be up more than 6%.

compared to January volumes. February 2023 U.S. vehicle sales are.

approximated to translate to an approximated sales pace of 14.4 million.

units (seasonally adjusted annual rate: SAAR), a marked decrease.

from the month-prior figure, although the hidden sales rate, as.

represented by the everyday selling rate metric, should advance.

slightly.” Auto need levels so far this year have actually sustained the patterns.

converging in the market at the end of 2022,” said Chris Hopson,.

primary expert at S&P Global Mobility. “Perhaps significantly,.

fleet sales as a portion of overall regular monthly volume have actually intensified.

over the previous few months. While this could be an additional signal.

that vehicle consumers continue to face an unpredictable purchase.

environment, fleet enhancements are not unanticipated, as vehicle.

production and stock levels continues to advance.” Regarding the automobile production environment, “While demand.

destruction issues remain pervasive, production levels are well.

underway, which should enhance car availability by mid-2023,”.

said Joe Langley, associate director of research study and analysis for.

S&P Global Mobilitys North American Light Vehicle Forecasting.

& & Analysis team. “Greatly enhanced car availability might in.

turn promote demand as reward levels are expected to.

boost.” The S&P Global Mobility automobile outlook for 2023 continues to.

bring a countercyclical story: We expect production levels will.

continue to improve even as financial conditions are getting worse.

through the early stages of the year. Together with improving.

production volumes, reports of sustained retail orders, recuperating.

automobile inventory, and more fleet demand we need to see enhancements.

even with worries of an economic recession. S&P Global Mobility.

projections calendar-year 2023 sales volume of 14.8 million units, a.

7% boost from the 2022 tally.Sustained development of battery-electric vehicle (BEV) sales.

stays a continuous presumption for 2023. The Tesla and Ford rate.

adjustments must continue to boost the regular monthly BEV share to.

record levels, as reports reflect that the downward rate motion.

for its items has actually improved demand. BEV share in February is.

estimated to reach 8.0%, continuing the momentum realized in.

January. Whether these pricing adjustments will be matched by the.

likes of Hyundai, Kia, and Volkswagen and become a BEV rate war,.

the response of other automobile companies will identify whether the.

gains in the BEV mix level will be a blip or a tipping point in the.

electrification progress of the market.

Leave a reply