The inevitable transformation of the bus industry

This short article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Issues such as low speed, low performance and congestions are

common throughout cities in South America. With more than 12 million

individuals, Sao Paulo is the regions largest city and has actually become a.

good example for movement efforts. In 2021, more than 4.5 million.

passengers were carried per day, according to SPTrans – Sao.

Paulos transportation department. Sao Paulo operates a bus fleet of.

13,800 automobiles. Gradually, Sao Paulo has actually ended up being a center for pilot.

jobs in the movement sector. For instance, Sao Paulo was one the.

Cities to restrict vehicles and trucks in the city. Sao.

Paulo has actually adopted bus corridors and improved the average speed of.

buses. Making use of articulated and bi-articulated buses on some.

paths also improved the effectiveness of public transport.Looking ahead, brand-new efforts are likely to focus on climate.

and environment. Sao Paulos environment committee created in 2009.

recommended rules for cleaner mass transit. In 2021, a new.

schedule was adopted: the carbon emission will be cut by half in.

2027 (based upon overall emission in 2016), and by 100% in 2037.

Particulate matter has to be cut by 90% in 2027, and by 95% in.

2037. The brand-new guidelines suggest that bus fleet operators will have to.

spend more on cleaner buses and the required facilities. Sao.

Paulo is among the cities in South America that participates in the.

Zero Emission Bus Rapid-deployment Accelerator (ZEBRA) program that.

promotes a shift to brand-new technologies and will that alter the.

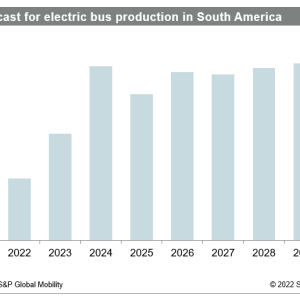

vehicle industry.According to S&P Global Mobility Medium and Heavy Commercial.

Vehicle (MHCV) Industry Production forecast, Brazil was the fourth.

largest bus and chassis producer in the world in 2021, and nearly.

90% of buses produced in Brazil have metropolitan applications. Brazil.

will keep its rank in 2022. In the future, Brazils bus production.

requirements to transition to electric powertrains to keep its position.

and to continue to increase its output. Brazil is the significant bus.

producing country in the region and serves with its chassis bus.

bodybuilders throughout South America. Brazilian OEMs have actually served the.

region for decades and deals now CNG/LNG vehicles to comply with.

Euro VI. These brands are now challenged by Chinese OEMs that use.

total buses at lower costs. This has been witnessed recently by.

the effective bids of BYD, Foton and Yutong in Chile and Colombia,.

insofar as a huge part of the bids consist of electrical buses.Among bus producers, BYD was the pioneer bringing its electrical.

designs to be assembled in Sao Paulo state. Volvo, Mercedes-Benz,.

and Volkswagen already developed their models with launch timing in.

2023. On the other hand, Scania and Iveco have gas as.

solution for alternative propulsion; meanwhile, Agrale has developed.

partnerships to go into in the electric field. Additionally, Higer is.

another newbie in electric lorries offering their products in.

Brazil. But it hasnt all been great, the absence of government.

reward rewards for new technology creates barriers for.

electricity. The shortage of elements brought instability and.

concerns for market. The rate of new innovation is another.

charge, and the last price – it approximated an electric bus is.

three times more expensive than traditional bus. Obviously, the.

initial expenses will fall as the technology ends up being more common.

However, in the first moment the boost of operation expenses will.

bring modifications in subsidies or public ticket prices.In reality, buses will be the entry point for electrification in.

South America, although the some movement has been noted in.

medium-duty segment, in small scale. OEMs settled in Brazil have.

fantastic prospective to increase their production and rebound their.

earnings margins due to new innovations and increase their.

penetration in South America nations, which brings more incomes.

for their headquarters. The use of electrical innovation.

has actually increased internationally, and the modification will be needed to maintain.

Brazil at a competitive level for the bus industry. On the.

passenger side and bus motorist side, the convenience and security provided.

by electrical buses might attract more users for public transport, and.

a decrease in occupational illness and mishaps for bus fleet.

operator. A decrease of greenhouse gas emissions has favorable.

outcomes for environment, meanwhile the public sector promotes social.

wellbeing with decrease of federal government health expenses. In.

other words, it may benefit market, excellent for users and good.

for the climate simultaneously.

Leave a reply