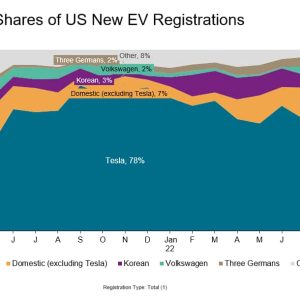

Tesla share of EV market declines; Domestics, Koreans and Europeans gain

This short article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled division of S&P Global.

As new electrical vehicle brand names and designs come to market, market

shares are changing appropriately. Tesla stays the dominant gamer,

but its share slowly has been decreasing given that the fall of 2021,

as revealed listed below. From 77.8% in November 2021, Teslas EV share has

dropped more than 20 percentage points to 57.1% this previous November.

Put another way, Teslas one-year decline itself amounts to more

than a fifth of the entire United States EV market. At the very same time, EV

shares of non-Tesla domestic brands, the Koreans, Volkswagen, and

the 3 German high-end brand names have risen.One reason for Teslas decrease is the increase in EV design

count. Fifty-one EVs now are available, a 59% boost from 32

models simply one year earlier. These brand-new designs represented 10,390 new

registrations in November 2022, equal to 15.1 % of the EV market.

4 of these brand-new entrants, including the Ford F-Series Lightning,

BMW i4 eDrive40, Hyundai Ioniq 5 and Rivian EDV, on their own had

6,018 shipments in November or 58% of all brand-new EV design

registrations.A second – and related – motorist of moving EV brand name market

shares is the change in migration patterns from ICE (Internal.

Combustion Engine) to EV. Households with an ICE vehicle in the.

garage that go back to market and get an EV are acquiring a.

Tesla at considerably lower rates than a year ago – this holds true.

for all makes other than Porsche, where the decrease is marginal. Of the.

15 mainstream and 13 high-end brands with considerable return to.

market volumes this previous fall, everyone had fewer owners (who.

obtained an EV) migrating to Tesla versus the year before. The.

chart below highlights that the modification in movement to Tesla.

declined by 20 percentage points or more for 5 of the fifteen.

mainstream brand names and 3 of the thirteen luxury brands.This decrease in industry-wide motion to Tesla is supported by.

S&P Global Mobility conquest and defection data. As shown.

below, while Teslas conquest/defection ratio has been erratic, it.

plainly is down this previous fall when compared to a year ago,.

dropping 2.1 points to 4.6. Lower migration from non-Tesla brand names.

to Tesla, everything else being equivalent, lowers Tesla conquests which.

decreases its ratio.The development of the US EV market will speed up as more designs.

show up. There are 51 models on the marketplace now (with at least one.

new registration in November), and this will rise to 78 by the end.

of 2023; then the EV design count will more than double to 160 by.

the end of 2025. This increase will put down pressure on EV share.

for all brand names, consisting of Tesla.Note: All market share calculations are based upon total brand-new.

light-vehicle registrations.

—————————————————————————— Top 10 Industry Trends ReportThis vehicle insight becomes part of our monthly Top 10.

Industry Trends Report. The report findings are drawn from.

secondhand and new registration and commitment data.The December report is now available, incorporating November.

2022 CFI and LAT information. To download the report, please click.

below.DOWNLOAD REPORT.

Leave a reply