S&P Global Mobility predicts strong monthly SAAR for October

This post was released by S&P Global Mobility and not by S&P Global Ratings, which is an independently handled department of S&P Global.

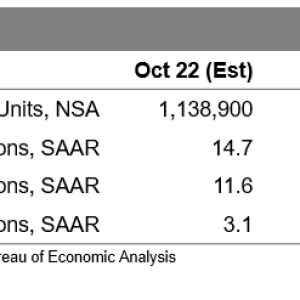

On predicted volume of approximately 1.139 million systems, United States

auto sales in October will reach a seasonally adjusted annual rate

( SAAR) of 14.7 million systems, according to S&P Global Mobility

quotes. While this would mark the strongest month-to-month SAAR level

in eight months, the underlying characteristics of the marketplace stay in

flux.” Pockets of car stock levels continue to improve

more quickly than gotten out of extraordinarily low levels and

bring welcome news on the supply side of the formula. However,

auto consumers are likely feeling the pressure of existing financial

headwinds,” according to Chris Hopson, Principal Analyst at

S&P Global Mobility. “While we continue to indicate

stock levels as a significant consider stemming immediate-term

momentum in auto sales levels, the degrading economic

conditions are ending up being more widespread.” Hindered by higher rate of interest settings and lower levels of

jobs growth than formerly anticipated, consumers are anticipated to

retrench – thus becoming a significant input factor to automobile demand

levels over the next 12-18 months. In its October 2022 US Economics

update, S&P Global Market Intelligence group has revised

downward its forecast of genuine GDP growth in 2023 from 0.9% to

-0.5%. The base forecast now includes a mild recession beginning in

the fourth quarter of this year, with an anemic recovery taking

keep in the third quarter of next year.If theres a silver lining, the potential for faster new-vehicle

inventory development should enable down pressure on automobile

prices and supply some clearance for car customers willing to

test the marketplace in 2023.

Leave a reply