Plenty of ’22 models still on the shelf

For all the talk of low inventories, and vehicle dealerships tacking

” market modifications” on top of MSRP, there were nearly a.

half-million systems of leftover 2022 design year lorries still.

advertised for sale in the United States heading into the first.

weekend of December. That is on top of the 2023 lorries that have.

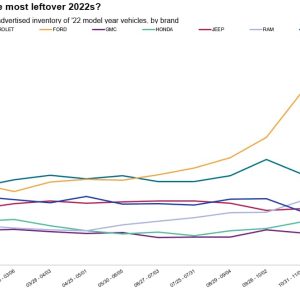

been arriving on dealer lots.According to S&P Global Mobilitys analysis of United States dealer.

promoted stock data, mainstream brands Ford, Chevrolet, Ram,.

and Jeep had about 300,000 units of 2022 designs advertised as.

readily available for sale the week ending December 4. Those four brand names.

account for 71% of 2022 advertised inventory noted by mainstream.

brand name dealerships – and 66% of all dealer-advertised inventory when.

including luxury marques.Among high-end brands, Mercedes-Benz and Lincoln still revealed the.

most remaining 2022 lorries in dealer marketed inventory,.

according to the S&P Global Mobility analysis.While most automakers traditionally ease off production in late.

summer season to transition to the new model year, and clear out the last.

of their old models by Christmas, particular car manufacturers actually have.

seen their 2022 stocks increase in October and November.” Model year discipline has receded,” said Cheryl Woodworth,.

consulting associate director for S&P Global Mobility. “With.

the chip shortage, inventory control is not as careful as it.

utilized to be.” Is running old inventories into the new model year a bad thing?

It can be for car manufacturers, but it could spell retail relief for.

consumers. With 22 designs carrying the preconception of being “older” -.

even if the 2023 design is unchanged – that can indicate dealers are.

incentivized to blow out the zero-miles 22s.” The longer you wait to change over your model year, the more it.

hits your residual worths in regards to tougher grading,” Woodworth.

said.Some dealerships are offering below-MSRP discounts on cars that.

carried sticker-price-plus Monroney labels just months prior to. And.

with consumer need subsiding due to external economic forces such as.

inflation and recession-related layoffs, the pressure to move the.

metal increases.Usually, the stock arc for each model year follows a.

predictable curve, peaking in spring as production strikes its stride,.

and after that coming down in summer season throughout the annual selldown and the.

design year shifts in September and October. Supply chain.

chaos has actually made it impossible for some automakers to follow.

tradition.That said, with certain elements of the supply chain still in.

flux, it may make sense for making continuity to continue.

developing 2022 designs if a 2023 minor model change consists of a part.

that is not readily available, Woodworth said.In November, Ford was still providing 2022 Escapes to.

car dealerships from its Louisville factory, as the 2023 minor model.

modification is still increase. The same continuation of late.

production 22 designs uses to the Ford Bronco Sport and Lincoln.

Corsair, which share a number of their foundations with the Escape.

platform.Remaining 2022 systems are typically specific to specific designs. In.

the market for a luxury SUV? The designs with the greatest staying.

2022 design year units are the Mercedes-Benz GLC and Lincoln.

Corsair.Why the excess 22 Mercedes GLCs? Its still awaiting a 2023.

refreshing – the national mbusa.com site still wasnt listing.

the 2023 as available on December 15 – and as such 2022 designs are.

still in strong supply. Amongst luxury brands, Mercedes had 33% share.

of remaining 22 models still marketed the week ending December.

4, while Lincoln accounted for 22% share of remaining luxury.

22s. That said, Mercedes dealerships have done a strong job of selling.

down its 2022 stocks from mid-summer in anticipation of the.

23 model showing up. And other crucial Mercedes volume models – GLE,.

S-Class, and C-Class – are mainly represented by 2023 model.

production.Supply chain hiccups likewise are affecting inventories in other.

methods. Tens of countless so-called “ghost systems” of the F-150 and.

Chevrolet Silverado have actually rolled off the assembly line but were.

missing essential parts, and have actually been gathering in parking lots.

near their respective factories until they can be released. On top.

of those unfinished systems, Ford dealers had almost as many F-150s.

marketed the week ending December 4 as they did in August in.

September. When the ghost systems finally receive their needed parts.

and enter wholesale inventory – Ford hopes it will take place by the.

end of December – that will include to the pressure to clear out the.

22 models at the dealership level.The combined black-swan occasions of COVID, semiconductor.

shortages, and the Russian invasion of Ukraine interfered with.

standard manufacturing and supply norms – the current downstream.

impact being the overrun of previous model-year production and.

inventory. How the industry can recover to its routine cadence.

depends upon its flexibility to these continued disturbances.

This article was released by S&P Global Mobility and not by S&P Global Ratings, which is an independently managed division of S&P Global.

Leave a reply