Load-shedding disrupts recovery in South Africa truck and bus assembly

When transport is anticipated to move to electric, at a time

drivetrains and industrial lorry OEMs scale back financial investment in

combustion engines, these electric cars pose a big challenge

to South Africa, which has an undependable power supply. The existing

power restrictions result in lowered output of medium and heavy

commercial cars in 2022. Considering that 2007, South Africa is experiencing a higher power demand

than supply. Power cuts have actually been the outcome. Eskom, the

state-owned company which provides more than 90% of South Africas.

electrical energy, then came up with the term, load-shedding, for the.

power cuts. In the previous years, load-shedding increased from 21 days.

in 2019 to a record 48 days in 2021. January to August 2022 already.

exceeded this number. The most recent analysis on the topic forecasts.

power cuts to continue throughout the decade. More than 90% of.

South Africas energy is produced by coal, about 6% by nuclear.

power and the build-up of alternatives is very slow.The worldwide developments in electrical trucks and buses are also.

seen in South Africa and the nation requires to be integrated into.

the worldwide worth chains for these lorries. This was why the South.

African federal government drafted in 2021 a federal government Policy Discussion.

Paper, on the Advancement of New Energy Vehicles in South Africa,.

which dealt with this particular agenda.South Africas path to production of brand-new electrical lorries requires.

to be thought about within the context of the considerable impact of.

on-going load-shedding. The constrained power grid on electricity.

generation and ensuing power interruptions are devastating.

especially for the market. The vehicle logistic value chain.

has actually currently been impacted, resulting in partial production blockages.

in truck and bus production. This could cause a major barrier to.

future investment in assembly facilities in South Africa.Apart from international supply chain disruption and fuel price hikes,.

load-shedding has actually become the greatest obstacle to the medium and.

heavy commercial lorries in the country. It is now expected to.

disrupt and adversely affect the truck and bus assembly recovery.

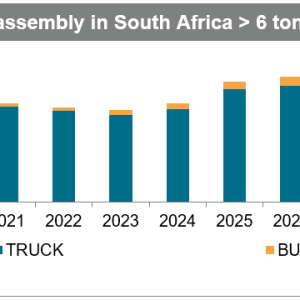

S&P Global Moblity (previously IHS Markit|Automotive) has.

decreased its outlook for the truck and bus industry that is expected.

now to put together less than 20,000 units in 2022, a decrease of almost.

1,000 units compared to the prior year.In addition to prolonged load-shedding which has contributed to.

increased production expenses, the market is continually faced with.

semiconductor scarcities; and worldwide supply chain disturbances that.

have actually resulted in inadequate completely-knocked-down kits for.

truck and bus assemblers. The global chip shortage problem is.

anticipated to continue in 2023, with the backlog rollovering into.

2024. Regardless of progressively hard economic circumstances, the.

semiconductor supply chain lack will go back to normality from.

2025 onwards. The essential chauffeurs behind this path to a long-lasting.

sustainable growth for the market will originate from constant.

development in infrastructure advancement, increasing logistics.

services, and ongoing replacement demand.Throughout the forecast horizon to 2029, trucks and buses are.

projected to be entirely powered by fossil fuels. Unless concrete.

policies for sustainable development are adopted, nonrenewable fuel sources will.

continue to control the marketplace; despite the fact that leading OEMs have.

started with their own strategic plans of importing electric.

trucks and buses from their moms and dad business for regional testing,.

with commercialization primarily prepared after 2025. The South African government already has strategies of progressively.

increasing the carbon tax rate and is expected to reach a minimum of.

$ 30 per tonne by 2030. This requires that OEMs develop strategies that.

slowly minimize their emissions; by buying carbon-neutral.

assembly centers and phase out the internal combustion engine.

The switch to electrical automobiles can only achieve success if the power.

restrictions are resolved and the charging facilities is developed,.

because most long-distance land freight in South Africa is.

transferred by road.Menzi Nkonyane, Sr Research Analyst – Truck & & Bus Research,.

Middle East/Africa.

Published 21 September 2022 by Menzi Nkonyane, Senior Research Analyst, Truck & & Bus Research, Middle East/Africa, S&P Global Mobility.

This short article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled department of S&P Global.

Leave a reply