EV Chargers: How many do we need?

This short article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled department of S&P Global.

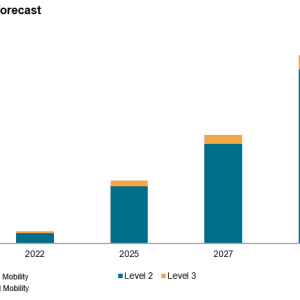

Source: EVgoS&& P Global Mobility registration data shows that there are 1.9 million electric lorries (EVs) in operation today, or 0.7% of the 281 million vehicles in operation, as of October 31, 2022. EV market share for new automobiles is likely to reach 40% by 2030, according to S&P Global Mobility forecasts, at which point the overall number of EVs in operation could reach 28.3 million systems. Looking even more to 2030, with the presumption of 28.3 million units EVs on US roadways, an estimated overall of 2.13 million Level 2 and 172,000 Level 3 public battery chargers will be required – all in addition to the units that consumers put in their own garages.

” In slower-to-adopt states, development of EV charging infrastructure might be more dependent on the stimulate of public-private financial investment to lead advancement of an EV charging facilities somewhat ahead of full need.The four U.S. states with the greatest number of cars in operation and highest new-vehicle registrations typically are California, Florida, Texas and New York. It is the biggest EV market, with about 36.9% of total EVs in operation and 35.8% of overall United States light-vehicle EV registrations from January through September 2022. As EV adoption grows in the United States, the power of ZEV states remains important to EV development, but there is little doubt we will see the essential investment in these markets provided the top-down (federal government) and bottom-up (consumers and charging network operators) support for advancement in order for the United States to achieve its target for EV adoption.

Texas presently has about 5,600 Level 2 non-Tesla and 900 Level 3 chargers, but by 2027 S&P Global Mobility forecasts that the state will require about 87,500 Level 2 and 7,800 level 3 chargers to support an anticipated the expected 1.1 million EV VIO at that time.Meanwhile, Florida presently has about 5,600 Level 2 non-Tesla battery chargers and 955 Level 3 battery chargers, however is anticipated to have 1.06 million EV VIO potential in 2027. To support these automobiles, S&P Global Mobility projections that Florida will require to grow its charging facilities to about 77,000 Level 2 and 6,800 Level 3 charging stations.There likewise stays lower investment into charging systems beyond significant city markets. EV adoption in those locations will continue to be slower, producing a robust facilities is essential there. Currently, 85% of Level 3 battery chargers are in US Metropolitan Statistical Areas (MSAs as defined by the US Census Bureau, and consisting of 384 city areas); 89% of Level 2 chargers remain in these locations. For Tesla owners, 82% of its Superchargers and 83% of its location chargers remain in MSAs.” The focus on urban locations follows where EVs are today, however circulation will need to be much larger as cars in operation grow, and consumers need to charge along their paths,” McIlravey said.Some industry experts look to the fuel service station as a similar design to electrical automobile recharging. However as at-home recharging is in many cases the simplest solution to incorporate an EV into every day life, a robust charging facilities will look much different from the network of filling station that has developed to support the internal combustion engine.The technology behind EV battery chargers, battery management systems, and battery innovations are causing quicker charge times for DC or Level 3 circumstances, which in turn can affect the areas of charging stations.There also are evolving options efficient in altering the model. Battery switching, cordless charging, and increased deployment of DC wallbox solutions in the house are three solutions which still can change the landscape. In China, the practice of battery switching is growing and has had some success, though it has seen practically no application in Europe beyond the first NIO stations in Norway, and not yet actually checked (nor expected) in the United States market.” Theres the tendency for home charging, the lack of governmental regulation, and the need to homogenize battery packs – which would see OEMs and Tier 1 suppliers give up some of their copyright – keeping back an innovation like battery swapping,” stated Graham Evans, S&P Global Mobility research and analysis director.Of cordless charging, Evans says that prevalent adoption of the innovation has the prospective to challenge the current stand-off between battery size and range. Evans says consumers will be able to charge more conveniently in your home and adopt splash and dash habits if dynamic cordless charging becomes extensive. The cost of wireless charging may be a problem, and mainstream customers may not be interested in paying a premium for wireless charging, Evans warned. Plug-in technology was very first to market in addition to being more economical, which leaves implementation of wireless crediting play capture up regardless of whether it might be superior in regards to convenience.The third technology with prospective to shock our existing assumptions are at-home DC wallbox options. According to Evans, they provide a midway solution between slow air conditioner chargers and the superfast public DC chargers. Wider implementation of these options has prospective to shift the balance in the domestic versus public charging conundrum. There are designs offered that assist in V2G (vehicle to grid) operation, which has possible to change the conversation by enabling EVs to effectively end up being part of our electric grid system and leading to some monetary return for participating consumers.As the US lorry market transitions from internal combustion to battery electric, the refueling system is transitioning with it.” For mass-market acceptance of BEVs to take hold, the recharging infrastructure needs to do more than keep pace with EV sales,” Evans stated. “It needs to amaze and delight lorry owners who will be brand-new to electrification, so that the process seems smooth and maybe even more practical than their experience with gasoline refueling, with very little compromise on the vehicle ownership experience. Developments in battery technology, and how rapidly EVs can receive power, will be as crucial to enhancements here as how quickly and plentifully facilities can supply the power.”.

Supporters of vehicle electrification point to the more than 140,000 EV charging stations currently deployed across the United States – consisting of Level 2 Air conditioning and Level 3 DC fast battery chargers and both restricted and public gain access to systems – as an indication that a budding system to support our transport transformation is in place.However, S&P Global Mobility information shows that the charging facilities is not nearly robust adequate to completely support a developing electric vehicle market.Even when home-charging is taken into account, to appropriately match forecasted sales need, the United States will require to see the number of EV chargers quadruple between 2022 and 2025, and grow more than eight-fold by 2030, according to S&P Global Mobility projections. It is the largest EV market, with about 36.9% of total EVs in operation and 35.8% of total United States light-vehicle EV registrations from January through September 2022. As EV adoption grows in the United States, the power of ZEV states remains important to EV development, but there is little doubt we will see the necessary investment in these markets provided the top-down (federal government) and bottom-up (consumers and charging network operators) support for development in order for the United States to achieve its target for EV adoption. Texas presently has about 5,600 Level 2 non-Tesla and 900 Level 3 chargers, however by 2027 S&P Global Mobility projections that the state will need about 87,500 Level 2 and 7,800 level 3 chargers to support an expected the anticipated 1.1 million EV VIO at that time.Meanwhile, Florida presently has about 5,600 Level 2 non-Tesla battery chargers and 955 Level 3 battery chargers, but is expected to have 1.06 million EV VIO potential in 2027. As at-home charging is in a lot of cases the simplest service to incorporate an EV into daily life, a robust charging facilities will look much various from the network of gas stations that has progressed to support the internal combustion engine.The innovation behind EV chargers, battery management systems, and battery innovations are leading to faster charge times for DC or Level 3 situations, which in turn can impact the places of charging stations.There likewise are developing services capable of changing the design.

Supporters of car electrification indicate the more than 140,000 EV charging stations presently released throughout the United States – consisting of Level 2 a/c and Level 3 DC fast battery chargers and both public and restricted gain access to units – as a sign that a budding system to support our transport transformation is in place.However, S&P Global Mobility data reveals that the charging infrastructure is not almost robust adequate to fully support a developing electrical car market.Even when home-charging is considered, to appropriately match forecasted sales need, the United States will need to see the variety of EV battery chargers quadruple between 2022 and 2025, and grow more than eight-fold by 2030, according to S&P Global Mobility forecasts.” The shift to a car market controlled with electrical automobiles (EVs) will take years to fully develop, however it has started,” said S&P Global Mobility expert Ian McIlravey. “With the transition comes a requirement to progress the general public car charging network, and todays charging facilities is insufficient to support a drastic boost in the variety of EVs in operation.” S&P Global Mobility approximates there are about 126,500 Level 2 and 20,431 Level 3 charging stations in the United States today, plus another 16,822 Tesla Superchargers and Tesla destination chargers. The variety of chargers has actually grown more in 2022 than in the preceding 3 years integrated, with about 54,000 Level 2 and 10,000 Level 3 chargers included during 2022

.

Leave a reply