December auto sales wrap up year on a familiar note

This post was published by S&P Global Mobility and not by S&P Global Ratings, which is an independently managed division of S&P Global.

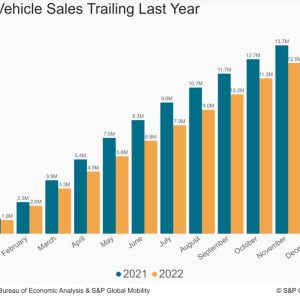

Degrading economic circumstances set stage for an

unsure 2023 landscapeWith volume for the month projected at 1.19 million systems,

December U.S. auto sales are estimated to translate to an estimated

sales rate of listed below 13.0 million units (seasonally adjusted annual

rate: SAAR). The SAAR reading would be the weakest monthly outcome

considering that May 2022, and the underlying day-to-day selling rate metric would

be a minor step back from the pattern of the preceding three

months.The everyday selling rate metric in December is anticipated to

slow down slightly from the incredibly constant 44.9 K daily average

given that August. While stubbornly sticky low levels of stock

moistened year-end clearance rewards, the backward movement in

the day-to-day selling metric could be a signal of a retrenching auto

customer. The December result will bring the full-year U.S. light

vehicle sales total to 13.8 million systems, an 8% decrease from the

CY2021 overall.” Looking back at a troubled year for automobile demand, the December

sales result shows apparent steadiness in the market,” said

Chris Hopson, primary analyst at S&P Global Mobility.

” Steadiness needs to not be misconstrued as exuberance. Automobile

customers are plagued by an unsure financial environment, high

car rates, greater rate of interest, and low stock

levels.” None of these problems will be solved quickly as the marketplace

relocations through 2023. The S&P Global Mobility car outlook for

next year carries a countercyclical narrative: Expected production

levels will continue to increase, even as economic conditions are

expected to deteriorate through the early stages of next year.” The advancing production levels, together with reports of

sustained retail order books, recovering stock of automobiles, and a.

fleet sector that stays starved for item, need to provide some.

inspiration to vehicle need levels even as a financial recession looms,”.

Hopson said. “We forecast calendar-year 2023 sales volume of 14.8.

million systems in the U.S., a 7% increase from the estimated 2022.

tally. But even as the industry intends to leave 2022 in the evaluation.

mirror, uncertainty awaits entering the New Year.” (For S&P.

International Mobilitys full 2023 Global outlook, click here). Next year will see the sustained advance of battery-electric.

cars. BEV share of new light lorry sales in the U.S. is.

anticipated to reach 6.2% in December 2022, which would equate to a.

full-year share of 5.4% – a YOY volume growth estimate of.

approximately 260,000 systems. Additional electrificaton development in.

2023 will be sustained by product rollouts including the Lexus RZ,.

Fisker Ocean, a wave of BEV product from GM consisting of the Chevrolet.

Equinox EV and Chevrolet Blazer EV, and advancing Tesla production.

levels. Rewards as directed by the IRA must likewise promote.

sales.

Leave a reply