Automotive brand loyalty rate dips below 50% for third straight month

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled division of S&P Global.

The lack of automobiles offered to retail customers –

triggered by the pandemic and semiconductor lack – has actually resulted

in consumers leaving their preferred brand names in record

numbers. The link in between commitment and days supply is extremely strong,

and as inventories have actually fallen, so has loyalty.New automobile registration data suggest that household loyalties

at 4 strata – producer, model, brand name, and section – all are

at their least expensive levels since at least the start of 2019, according

to an S&P Global Mobility analysis.Vehicle registration data for July 2022 – the most current information

readily available – marked the 3rd successive month in which households

returning to market were most likely to flaw than remain faithful to

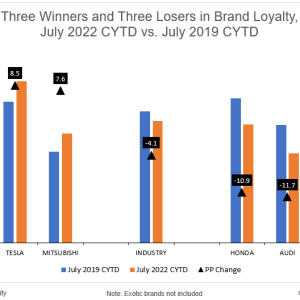

the brand in their garage.Industry-wide brand name commitment in July was simply 49.4%, the most affordable

of any month in 3 years. Manufacturer commitment of 55.9% also was

the most affordable any-month level for the period.Segment loyalty pulled away to simply 32.2% in July, below 35.8%.

three years back, while model commitment of 24% is down more than 3.

portion points from three years earlier. Both numbers were the.

lowest any-month outcome in this time span.As an outcome, owners who brand names and dealers trust to return for.

the same lorry – and who have actually returned in the past – now.

are defecting at a higher rate than they are returning. That puts.

a brand names market share and a dealers earnings at danger. It is.

incumbent on dealerships and brands to proactively connect to their.

owner bases to decrease defections.But these elevated defection rates also are an opportunity for.

car manufacturers already seeing a return to more powerful stocks. OEMs.

and dealers can make the most of this landscape by reaching out to.

the suitable audiences to draw in these more migratory.

homes. If a re-designed or brand-new design is getting here with a.

stronger item or value proposal than its rivals, in.

enough numbers, this might be prime-time show for conquesting.

consumers.

—————————————————————————————– This vehicle insight is part of our month-to-month Top.

10 Trends Industry Report.The Report findings are.

drawn from secondhand and new registration and loyalty data.The September report is now readily available, incorporating July 2022.

CFI and LAT information. To download the report, please click below.DOWNLOAD REPORT.

Posted 07 October 2022 by Tom Libby, Associate Director, Loyalty Solutions and Industry Analysis, S&P Global Mobility.

Leave a reply