Fuel for Thought: The commercial vehicle fleet accelerates toward ZEV adoption

LISTEN TO A PODCAST ON THIS TOPIC

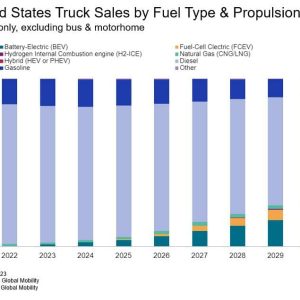

WITH S&P GLOBAL MOBILITY EXPERTSThe projected curve in tractor-trailer

electrification in the US is getting steeper, however a future of

roads filled with EV and hydrogen eighteen-wheelers is still scattered with

potholes.Tougher emissions regulations showing up in 2030,

emerging technological developments, and enhancements in the ZEV

medium- and heavy-truck cost picture with hydrogen in specific

have greatly increased the capacity for adoption of ZEV or

near-ZEV business vehicles.In weighing the aspects associated with

executing a ZEV big-rig fleet, S&P Global Mobility now

forecasts medium-term ZEV industrial automobile registrations in the

United States greater than ever in the past. Expectations for completion of

the years now reach almost 140,000 annual brand-new registrations of ZEV

trucks beginning in 2030, an anticipated share of more than 25% of the

Class 4-8 medium- and durable truck market.That stated, for all the pronouncements of a.

future of battery-powered Tesla Semis and hydrogen-fueled Nikolas,.

severe impediments stay on the road to mass adoption.Compared to previous forecasts, S&P Global.

Movements latest forecast represents higher volumes in system.

terms, as well as a more fast anticipated transition far from.

established internal combustion engine (ICE) innovations.

Revealed in regards to the substance annual growth rate (CAGR) of.

projection ZEV registrations, the speed of change has actually increased from 70%.

each year to 109% in just 2 projection rounds. This steeper expected.

adoption curve is due to more than just higher optimism about.

prospects for 2030. Regulative pushBullishness for 2030 has grown together with.

increasingly enthusiastic federal government policies and supports.

including the Inflation Reduction Act (IRA), proposed changes to.

Greenhouse Gas (GHG) Phase 2 standards, and proposed GHG Phase 3.

standards for MY 2028-2032 from EPA/NHTSA. The so-called GHG Phase 3 requirements reveal a.

bold initiative to push the speed of change in the industry.

dramatically lowering allowed CO2 emissions beyond the 2028.

limit visualized in Phase 2 to include tightening up and resuming.

already-published goals for model year 2027 diesel motor. By MY.

2032, the proposed GHG phase 3 policies will mandate an.

incremental OEM fleet typical emissions reduction of 37% in the.

medium-duty truck (MDT, consisting of Class 2b & & 3 )and 27% in the.

durable truck (HDT, Class 8) sectors, compared to the final.

2027 year of GHG Phase 2 standards.Regulatory bodies are wielding tax credit and.

coupon carrots along with legal adhere to accomplish their emissions.

targets. The 30% of value (up to $40,000) reward.

composed into the IRA (in the form of a tax credit) for services.

and tax-exempt companies that purchase a competent industrial tidy.

vehicle. In California, proposed incentives for a Class 8 hydrogen.

fuel-cell tractor under the Hybrid and Zero Emission Truck and Bus.

Voucher Incentive Project (HVIP) might reach as high as $240,000.

for a fuel cell electric truck.These IRA incentives also use to the expense.

side particularly for hydrogen-powered lorries in that.

incentives can shape the possible cost curve for refueling some.

ZEV vehicles. Relieving that expense problem would assist support the.

initial steep capital expense of the 2 chief hydrogen propulsion.

technologies hydrogen internal combustion (H2 ICE) and hydrogen.

fuel cell electrical propulsion (FCEV) in which fuel expenses loom.

large as a share of cost of ownership.But most of the technology forcing requireds are.

sticks such as the implementation of Tier 4 emissions for light.

industrial lorries and the Advanced Clean Truck and Advanced Clean.

Fleets legislation impacting California and at least 6 of the.

states that follow the California Air Resource Board (CARB).

mandates.The Advanced Clean Trucks guideline needs.

makers who sell medium-duty and sturdy vehicles (Classes.

4-8) to sell an increasing percentage of absolutely no emissions industrial.

automobiles from 2024-2035. A partner bill, the Advanced Clean Fleets.

guideline, is working its method through the rulemaking process. This rule.

locations requirements on fleets that meet certain characteristics to.

Have an increasing portion of absolutely no emissions business.

cars in their fleets. This rule likewise goes into result in 2024.

And by the end of 2023, California likewise is enacting stringent guidelines.

for the kinds of drayage trucks permitted to idle at intermodal.

seaports and railyards.Getting up to speedDespite the regulatory push, recent market.

efficiency for ZEV MHCVs has been silenced, with brand-new registrations of.

ZEV huge rigs up until now this year below expectations. While US.

registration volumes of Class 4-8 ZEVs in the very first 4 months of.

2023 had an impressive-sounding 200% year-over-year boost,.

supported by the registrations of the very first trucks from Nikola and.

Tesla, it represented barely 1,100 units and amounted to simply 0.6%.

of brand-new automobile registration volume and was 44% lower than.

forecast.Alongside uncertainty and expense, headwinds have.

consisted of the exact same supply-chain issues that have buffeted the.

production of standard diesel trucks and buses. Among them,.

manufacturers have actually counted lengthy wait times to receive parts;.

failure to source enough parts; troubles discovering workers.

and running full schedules; and raised input material prices.In some methods, these issues have been even.

more of an obstacle for dedicated ZEV start-ups, which have.

typically tighter capital, difficult cash burns, steeper.

interest rate in the existing inflationary cycle, and lower.

volumes (and hence income) to weather a supply-shortage storm,.

compared to larger, reasonably more established makers.In taking a look at market expectations from just six.

months back, delays in intros of brand-new Class 4-8 ZEVs have.

represented about a quarter of all known or thought.

start-of-production delays for truck and buses overall well above.

the ZEV share of the market.Dodging potholesThe current high cost of hydrogen fuel,.

considerably greater than diesel, has been expensive for the majority of.

prospective hydrogen automobile purchasers. Even in the case of the.

theoretically inexpensive acquisition cost of an H2 ICE truck,.

potential fuel costs have actually raised concerns about the benefits.

compared to other propulsion innovations. With the IRA raising the.

possibility of hydrogen fuel expense dropping dramatically, maybe even to.

as low as the diesel gallon equivalent, the chances for.

hydrogen become brighter, though still not specific. More.

than two-thirds of the boost in expected 2030 new ZEV truck and.

bus volumes comes from prepared for hydrogen truck and bus fuel.

cost declines.That said, enhanced potential customers for H2 ICE.

depends on H2 ICE items available for purchase. The current.

projection from S&P Global Mobility includes 7 H2 ICE truck.

models, all expected in Class 8. This is up from simply three designs.

projection this time a year ago.Over the next twenty years, battery electric.

trucks and fuel-cell electrical trucks are anticipated to go through.

substantial developments leading the way for increased effectiveness,.

decreased expenses, and larger market adoption. It is our expectation.

that, with next-generation battery innovation, trucks will see.

enhanced energy density and longer-range abilities, 2 very.

essential metrics for truck operations.Similarly, developments in hydrogen-related.

technologies are anticipated to bring longer variety and enhanced.

toughness making them more feasible for extensive adoption. As.

these technologies continue to grow, economies of scale will.

drive down production costs, leading to electrical trucks becoming.

more competitively priced.Overall, the main takeaway is that the market.

is at the early phases of development of this innovation. Enhanced.

capabilities along with reduced cost will just enhance their.

competitiveness and popularity of heavy-duty energized.

vehicles.Demand-side pledgesThere are also indirect elements that are.

neither the outcome of carrot nor stick. A number of.

business some controlling large fleets of commercial.

cars have made aggressive promises towards the accomplishment of.

carbon neutrality at a business level.For numerous of these fleets, transportation of.

goods is amongst the largest contributors to their business carbon.

footprint. For them, the reduction of carbon emissions from the.

commercial vehicles they manage is among the most impactful.

levers they can pull. PepsiCo has, as a corporation, promised to be.

carbon neutral by 2040 witness their reported purchase of Tesla.

Class 8 Semis. PepsiCo has actually taken shipment of 54 Tesla Semis to.

date, at about $450,000 each.PepsiCo is not alone. A number of customer.

items companies have actually made comparable promises to attain carbon.

neutrality by 2040 or 2050. For much of these companies, decreasing.

transportation-based carbon emissions uses a quicker and less.

capital-intensive approach to decreasing carbon footprint when.

compared to re-engineering production processes.Similarly, a few of the larger customer products.

transportation companies have likewise made carbon neutrality pledges with.

intent to fulfill their pledges by means of the aggressive purchase of.

ZEVs, some of them also in the “light” industrial lorry category.

Amazon has prepare for an overall of 100,000 custom electric.

community shipment lorries from Rivian by 2030, while FedEx has.

committed to carbon-neutrality by 2040, with all parcel pickup and.

delivery lorries being absolutely no emissions by that date.What requires to be doneIn the near-term, regulation, proclamation, and.

acquisition are not yet in positioning, and until they are, moving.

toward a zero-emission intermodal future faces roadblocks.In todays political environment, it seems.

likely that regulators will continue to intend ever higher.

no matter real-world economic truths. Gradually, this vision.

will be supported and re-adjusted by business conditions and cost.

truths on the ground including slower-than-expected early ZEV.

commercial car adoption, schedule of recharging/refueling.

networks, along with unexpected innovation “Eureka!” minutes and.

subsequent cost changes.But sluggish adoption now might also imply slower.

adoption in the medium term, as massive knowings are not.

accomplished and not shared. Lower numbers early on will likewise make it.

more difficult for disruptor brand names in the area to become and.

remain economically feasible, casting more doubt on a fast.

inflection point early on.

————————————————————– Dive deeper into these movement insights: Commercial Vehicle Forecast: MDHD.

truck market coasts through 2024Supply scarcities and brand-new electrical.

vehicle registrations for United States industrial vehiclesLearn more about Medium & & Heavy.

Business Vehicle Industry ForecastHydrogen: In it for the long.

haulCan Brazils commercial truck fleet.

turn electric?Learn more about Commercial Vehicle.

insights and intelligence.

This post was released by S&P Global Mobility and not by S&P Global Ratings, which is an independently handled division of S&P Global.

Leave a reply