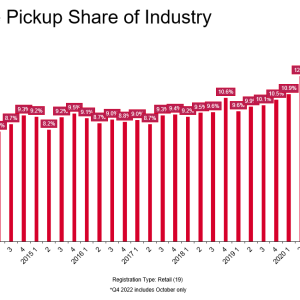

Pickup owners moving to SUVs (like everyone else)

The light-duty full-size half-ton pickup segment is one of the

most essential in the US market, for a number of factors: the 3

segment leaders are the highest-volume models from Ford, Chevrolet,

and Ram; the 3 pickups regularly likewise are the highest-volume

designs in the industry; there is extreme sales competition amongst

these 3 for boasting rights; and, it is commonly accepted that

these models are extremely profitable for their particular

automakers.Despite full-size pickups essential contributions to each brand names.

company case, the share of half-ton retail sales has been.

declining for more than 2 years. As revealed below, the segments.

retail shares in Q3 2022 and October 2022 were 7.8% and 7.5%,.

respectively – lower than in any other quarter going back to Q3.

2012. It is noteworthy that the durable full-size pickup share.

( three-quarter/one-ton designs) has actually been reasonably consistent during.

this time period, suggesting volume has not moved approximately this.

higher-profit segment.S&& P Global Mobility data reveal these share declines can be.

credited to increased migration of full-size pickup homes to.

sport-utility vehicles. As revealed listed below, the share of homes.

owning each of the 3 leading half-ton pickups staying devoted to.

the pickup body design has decreased in the previous year, while the.

share transferring to an energy has increased.The modification in re-purchase patterns for the Ram 1500 is the a lot of.

pronounced: the percent of these owners remaining design devoted has.

dropped nearly 9 percentage points to 42.5% in one year (Ram 1500.

design loyalty peaked at 54.7% back in June 2019), while the mix.

migrating to an utility has actually climbed up almost 6 indicate 41.6%. These findings align with the continuous increased movement to SUVs.

from all other body styles, a foreseeable pattern offered the.

myriad of energy options available based upon size, price, fuel.

type, sheet metal, and technologies. Through the very first 10 months.

of 2022, utility registrations accounted for 68% of retail high-end.

registrations and 61% of retail registrations industry-wide.

—————————————————————————— Top 10 Industry Trends ReportThis vehicle insight is part of our month-to-month Top 10.

Industry Trends Report. The report findings are taken from.

secondhand and new registration and commitment data.The December report is now available, including November.

2022 CFI and LAT data. To download the report, please click.

below.DOWNLOAD REPORT.

This short article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled department of S&P Global.

Leave a reply