Fuel for Thought: Automotive supply chain and technology themes for 2023

The end of cheap capital – integrated with worsening

macroeconomic conditions, the war in Ukraine, raw product

uncertainties, and the continuing chip shortage – will integrate to

mark 2023 as the beginning of an age when demand-side

considerations change the present supply-side fixation.Already, we are seeing these conditions affect the blossoming

movement start-up community. However in a bigger structure, the industry

will continue its pivot far from internal combustion engines

towards amazed lorries in all formats – in addition to the

exploration of connectivity and generating income from the reams of data

produced as the market looks for more earnings pools.CES 2023 indirectly highlighted a number of these

conditions and unpredictabilities. A shirking of ambiguous principles in

favor of production-ready products was primary. Visions

of unmanned pods and shuttles emerged, many brands focused

on very near-term product developments.For instance, Harman provided a handful of

production-ready products in the in-cockpit experience space, numerous

of which currently have OEM installation wins. Bose brought the next

generation of 3D audio and EV noise enhancement on display screen through

production cars. Blackberry showed Ivy – this time with

automotive-grade hardware all set to launch with Dongfeng Motors.

These examples paint a photo of business aiming to earn money

today, rather than focusing marketing dollars on abstract visions

of the future.Suppliers dealing with mounting pressuresA confluence of factors are challenging providers, and many

include externalities beyond the control of all but the most

durable.” The macro environment is not conducive to success for those

providers who dont have an excellent deal with on expenses, or a degree of

operational flexibility to handle the headwinds,” said Matteo Fini,

Vice President, Automotive Supply Chain, Technology and

Aftermarket, S&P Global Mobility.This is particularly real in Europe, where high energy expenses,

integrated with stagnant volumes and rising financing costs, will

create significant pressures for providers. The risk elements appear

heightened in Germany, where smaller Tier 1 suppliers – those with

earnings in between EUR100 and EUR500 million – and Tier 2 suppliers

appear the most exposed.In current months, German suppliers Ruester (vibration/damping.

items) and Dr. Schneider (ventilation and interior trim parts).

have actually applied for insolvency; Ruester faced liquidity problems.

following 2 acquisitions and rising input expenses. This may end up being.

a theme in 2023. With soaring energy prices, energy-intensive parts of the supply.

chain, such as metal foundries, that were already overstretched.

from investments contingent upon a return of pre-crisis volumes.

will need to reconsider their concerns for survival.Semiconductor shortages far from overAlthough demand-side softness will bring some relief in 2023,.

the structural capability deficit in semiconductors will take numerous.

years to solve.A downturn in other chip-hungry markets like telecoms and.

customer electronic devices indicated some semiconductor capacity in the.

sector was designated to vehicle in H2 2022. This will continue.

early into 2023. While there was plenty of financial investment in added capacity in 2021.

and 2022, it requires time to bear fruit. The preparation for equipment.

increased from one to two quarters to in between two and.

two-and-a-half years. The financial investment and CAPEX boom in 2022 will.

not lead to considerable additional capacity prior to 2024 or.

2025.” Aggregate need conditions are deteriorating worldwide due to.

the war in Ukraine, inflationary pressures, and usually.

macroeconomics. These conditions might mask the capability issues in.

2023, however no one must be deceived,” stated Jeremie Bouchaud,.

Director, Semiconductor, E/E and Autonomy practices, S&P Global.

Mobility. “The typical chip material per cars and truck is increasing at an.

accelerated rate due to the fact that of electrification. The capacity deficit.

will become visible again as quickly as demand from other industries.

choices up.” Analog chips will remain the bottleneck, as the variety of analog.

chips per vehicle increases faster than the variety of MCUs.

Additionally, analog chips dont diminish in addition to SoCs or.

microcontrollers. This indicates production stays on fully grown procedure.

nodes where there is inadequate capability and inadequate.

investment.To alleviate semiconductor threat, we expect that OEMs will rethink.

the method electronic devices are developed in their lorries. Expect.

increasing standardization of chips and reduced fragmentation. We.

anticipate OEMs to insist their Tier 1 providers use less customized chips.

or chips designed for single applications – likewise called ASICs and.

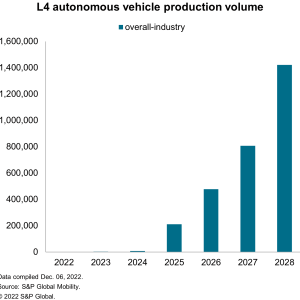

ASSPs – and use more general-purpose chips.ADAS, Autonomy and RobotaxisThough some might see the dissolution of Ford and VWs joint.

financial investment in Argo AI as a warning indication, the concept of autonomous.

taxis will continue forward – specifically among Chinese OEMs.” At the minute, tech business like Waymo, Cruise, and Baidu are.

viewed as winning the race. But first-mover status wont confer much.

sustainable competitive benefit,” stated Owen Chen, senior.

principal analyst for Autonomy in China with S&P Global.

Movement. “The very first part is only the technological presentation.

To deliver a robotaxi future, the much more hard piece to.

execute is the commercialization.” At issue: Neither investors nor the capital markets will foot.

the bill for initially weak ROI. Going into the commercialization.

stage, difficulties will emerge from robotaxi tech peers like Pony.

and WeRide, but likewise from the OEMs. Tesla and XPENG are targeting.

the shipment of robotaxis in 2023, but mobility providers like.

Waymo and Cruise (part of General Motors) will still lead the method.

in these early years.The automakers advantage? They currently are running a large.

ADAS fleet complete with Level 2+ applications. As such, they are.

training the software with data that comes free of charge from the.

countless automobiles already on the marketplace. By contrast, robotaxi.

tech business are burning cash to collect data from a far smaller sized.

pool of automobiles on the roads.Trained software application, developed on real-life information, is a more scalable.

course forward, and will be augmented by simulation to cover edge.

cases. However, it has not yet been shown that ADAS on-road.

content can be effectively pivoted to L4 on-road deployment.Considering commercialization and productization problems, cost.

discipline and awareness is a bread-and-butter competency of the.

OEMs. If Tesla and XPENG can demonstrate this technique in 2023,.

were going to see more tradition OEMs jostle for position in the.

robotaxi marathon. Tech business like Waymo and Baidu should have.

enormous cash reserves to sustain a position in the race before.

profits take off.Luring automotive software application talentConsumers are adapting to the idea of tech-focused.

transport. The pressure to provide new groundbreaking.

innovations will be huge for OEMs. But with software application spend set.

to grow at a CAGR of 7.7%, the requisite ability sets needed by OEMs.

wont come cheap.Furthermore, is the automotive sector an appealing enough.

market to draw in top skill in the highly competitive software.

engineering sector, when facing off versus tech companies and.

their own provider base? Already weve seen VWs CARIAD – an.

effort to produce a company with big tech behaviors – struggle to.

provide.” The automotive sector has a number of barriers in its course if.

it desires to establish its own software ecosystems,” said Dr. Tawhid.

Khan, Director, Software practice, S&P Global Mobility. “The.

industry is bound by process and legislation, and this does not make.

the sector particularly attractive to young software application graduates.

Finding a way to attract the essential skill to the market will.

be essential.” The ROI of linked servicesThe tumultuous economic and supply chain scenarios of the.

previous couple of years have put a concentrate on margin efficiency by.

car manufacturers, which have actually soared to tape-record highs. However OEMs wanting to.

continue those remarkable results will have a hard time as need for new.

automobiles deals with headwinds.The brand-new location for margin growth: add-on features and.

services.These linked services and paid updates can attain a margin.

of greater than 70%, that makes this space extremely appealing.

for a market looking for cover from the cyclical nature of selling.

vehicles. This new revenue stream has actually drawn in the attention of.

Wall Street, although predicted long-range revenue targets might be.

ambitious.The pre-COVID years included car manufacturers standardizing.

connection hardware in areas that do not typically support.

greater alternative rates, as well as the release of new generations of.

telematics manage system (TCU) hardware that will keep a connection.

active much longer.The last three years have seen releases of ingenious.

service-oriented business models beyond those provided by Tesla,.

with leading car manufacturers leveraging the flexibility of these.

services to change product packaging, pricing, and accessibility of.

functions.2023 is expected to be the introducing pad for similar features,.

with much broader usage cases, from mainstream fan car manufacturers.

This development will be vital to moving the concept of built-in.

upgradable material from headlines to reality.Raw materials supply and BEVsThe car industrys requirement to increase annual basic materials.

acquisition from its present level of 0.29 Terawatt hours (TWh) of.

lithium-ion batteries to about 3.4 TWh by 2030 will put.

extraordinary tension on the sector supply chain.In addition, the United States Congress passage of the Inflation Reduction.

Act (IRA) in 2022 might improve sourcing of and add intricacy to.

getting battery basic materials, while near-term inflation could.

speed up technique changes.The basic materials deficit, how the market addresses that, and.

the extra ramifications for sourcing choices on the carbon.

footprint are essential factors to consider. However sourcing these raw.

materials cant be secured in a laissez faire manner, as ESG.

considerations are collecting momentum.” The IRA has actually stimulated lots of OEMs and providers into destroying.

their battery playbooks for the United States market to secure access to.

manufacturing subsidies and purchase subsides for their consumers,”.

stated Graham Evans, Director, Battery, Charging, Propulsion, and.

Thermal practices, S&P Global Mobility.Soaring inflation is putting pressure on consumers, which could.

lead to an OEM pivot to resolve the changed macroenvironment.For example, does this indicate a switch to lower-tech battery.

solutions (and implicitly lower expense structures) such as.

Lithium-Iron-Phosphate cathode chemistries to secure higher.

margins? Or could it indicate increasing demand for batteries with a.

lower capacity and thus jeopardizing lorry range?Wireless charging and battery swappingPresently, just Mainland China has seen any demand for battery.

switching in the electrical automobile area -and that is mostly due to.

federal government incentives and geospatial concerns in cities that have.

driven its success.Nio, a key gamer in China, is releasing in Europe and has a.

handful of stations in Norway – so that market will be an.

fascinating petri dish for switching in Europe. In the US,.

California start-up Ample is trying to drum up interest in the.

fleet sector its targeting.While BMW and Hyundai (with WiTricitys Halo), and Volvo (with.

InductEV), have actually already dabbled with cordless charging, extensive.

adoption of the innovation has the possible to challenge the.

current stand-off between battery size and variety. The technology.

likewise suits fleet applications well, such as taxis.” Consumers might charge more conveniently in the house, and adopt.

splash and dash behaviors if dynamic wireless charging becomes.

widespread,” stated Graham Evans, Director, Battery, Charging,.

Propulsion, and Thermal practices, S&P Global Mobility. “.

mainstream customers might not be prepared to pay a premium for such.

convenience technology when the market has currently converged on.

the charging plug.” Large-scale switching has many other barriers in its method: In.

addition to the propensity for home charging, there is the lack of.

governmental directive, and the need to homogenize battery packs.

which would see OEMs and T1s surrender a few of their intellectual.

property.Consumer- and restricted-access charging might get a boost from.

DC wallbox battery chargers in the domestic charging sphere. These use a.

middle choice in between slow air conditioner battery chargers and the superfast public DC.

battery chargers. Their larger deployment has prospective to move the balance.

in the domestic vs. public charging conundrum. There.

are models readily available that facilitate V2G (car to grid).

operation, which could show more appealing in these energy.

cost-sensitive and conscious times.Euro 7 driving powertrain planningThe proposed Euro 7 emissions policies bring substantial.

capital-spend implications for innovation fitment on future.

internal-combustion vehicles.The watering down of Euro 7s initial framework will cause numerous.

OEMs to reevaluate the rapidity of their electrification rollouts.

Do the less stringent Euro 7 policies now make it worth OEMs.

purchasing another cycle of ICE updates? Or does it make more.

sense for an OEM to concentrate on electrification, and splinter their.

ICE and EV organizations as Renault and Ford have done? And how does.

this affect a supplier base increase to support E-motor.

applications?” The tightening up of electrical steel capability might likewise impact.

the electrification rollout,” stated Graham Evans, Director, Battery,.

Charging, Propulsion, and Thermal practices, S&P Global.

Movement. “A lack of e-steel might indicate that a planned product.

mix might change in the short- to medium-term in favor of ICE and.

hybrid applications, where theres much less need for steel, in.

particular high specification (extremely thin) electrical.

steel.” Meanwhile, the desire to squeeze more range and effectiveness from.

existing BEV criteria should trigger more in the industry to.

switch to silicon carbide (SiC) inverter technology.SiC inverters are more efficient, can also perform at higher.

temperatures and power output for a longer time. The tradeoff is.

cost. Major power electronic devices suppliers such as Marelli,.

BorgWarner, and Delphi Technologies have been significantly active.

in this location recently, developing their products and securing.

orders – which recommends that well see increasing SiC inverter.

adoption in the short-term. ———————————— Dive DeeperAutology Podcast: CES 2023 Day 1.

Recap – Listen HereAutology Podcast: CES 2023 Day 2.

Wrap-up – Listen HereAutology Podcast: CES 2023 Event.

Finish up – Listen HereAutoTechInsight Webinar: CES 2023 -.

Watch Now.

This short article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled division of S&P Global.

Leave a reply