Toyota Excels in US Retail New Vehicle Industry

This post was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled division of S&P Global.

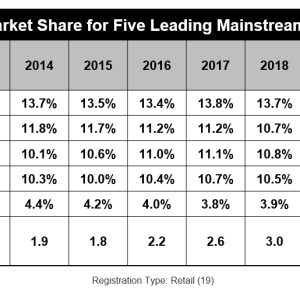

Amongst the three-volume leaders in the mainstream part of the new

vehicle market – Chevrolet, Ford, and Toyota, the Japanese brand

is retreating from the other 2, based on S&P Global

Movement new car retail * registration data.Toyota has been the retail market share leader every year since

2012 (see table listed below), and if its September 2022 CYTD retail share

of 14% holds through December, Toyota would lead for the 11th

consecutive year. Its 14% share also would be a record for the

brand name – and the very first time any brand name has reached that level in the

past years. Toyotas 4.1 portion point lead so far

this year over runner-up Ford is the second greatest margin this

years, gone beyond only by the 4.4 percentage point space last

year.Four Toyota designs (RAV4, Camry, Tacoma, and Highlander).

presently rank amongst the leading 10 (of practically 400 nameplates on the.

market) based upon September 2022 CYTD new retail registrations,.

consisting of the # 1 total design (RAV4), # 1 car (Camry), and # 1.

crossover (RAV4). No other brand name has more than one design among the.

leading 10 this year.Regarding brand loyalty, Toyota consistently ranks either 2nd.

( 7 times in previous decade) or third (four times) in the.

mainstream area, exceeded just by Ford or Chevrolet or both. Its.

current shortfall versus leader Ford of 2 percentage points is.

a little bigger than its 1.4 portion point gap for all of.

2021. Toyotas management position is strengthened by its segment-level.

efficiency. Among the 14 sectors in which the Toyota brand name.

contends, it presently ranks No. 1 in both retail share.

and brand commitment in 5, including the Compact Car, Compact.

Sport, Mid Size Car, Mid Size Pickup, and Mid Size Van Segments.

Together these five classifications represent almost a quarter of the.

mainstream area (22.3%). Further, in three extra sectors,.

consisting of the Compact Utility, Subcompact Plus Utility, and Full.

Size Car sections (with a combined mainstream share of 33.5%),.

Toyota models rank No. 1 in either retail share or brand commitment.

Assembled, these eight sectors in which Toyota leads in one or.

both classifications account for over half (55.8%) of the.

mainstream market, indicating that Toyota now has a management or.

highly competitive position in majority of the mainstream.

area. Toyota still lags in some key mainstream categories -.

particularly full-size pickups and SUVs where the domestic brands.

still control, and where Toyota has had a hard time to make a dent.Toyota also leads the mainstream market in electrification (EV.

and hybrid); its electrification share of 25.8% is nearly 10.

percentage points above runner-up Chrysler (see table listed below).

Admittedly, Toyota lags rivals Chevrolet and Ford in the.

high-visibility EV area, as both those brands provide established.

EVs with the Bolt and Mustang Mach-E, respectively, while Toyotas.

initially EV, the BZ4X, is just now launching. Hybrids play an.

important, though rather under-the-radar, function in alternative.

fuel migration patterns: Hybrid families migrate to an EV at more.

than three times the migration rate to EVs from ICE vehicles.Lastly, Toyota plainly leads its mainstream rivals in.

appealing to the three major ethnic backgrounds, a crucial achievement.

provided that African Americans, Asians, and Hispanics now account for.

a third of all new retail registrations. As shown below, Toyota.

brand commitment amongst both African Americans and Hispanics goes beyond.

60% (the only mainstream brand name for which this is the case), and.

Toyotas 48.5% brand name loyalty among Asians is more than 5 portion.

points greater than that of runner-up Ford.Given its record over the previous a number of years, Toyotas strong.

positions in retail share, brand name commitment, and ethnic loyalty.

support the claim that it is amongst the leaders, if not the.

leader, in the US mass market new lorry industry. * Retail consists of lorries registered to individuals.

—————————————————————————— Top 10 Industry Trends ReportThis automotive insight belongs to our monthly Top 10.

Industry Trends Report. The report findings are drawn from.

brand-new and used registration and loyalty data.The November report is now available, including October 2022.

CFI and LAT data. To download the report, please click below.DOWNLOAD REPORT.

Leave a reply