S&P Global Mobility: November auto sales continue previous three-month trend

Continuous economic headwinds suggest no news could be good news

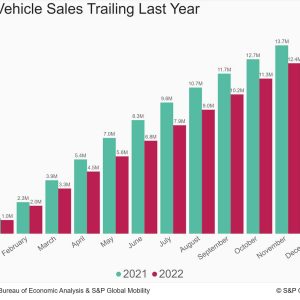

relating to car demand levelsWith volume for the month predicted at 1.122 million units,

November U.S. vehicle sales are estimated to translate to an approximated

sales speed of 14.1 million units (seasonally changed yearly rate:

SAAR). This would represent a sustained enhancement from the May

through September duration but will reflect a decrease from Octobers.

14.9 million-unit pace, according to S&P Global Mobility.

analysis.The everyday selling rate metric in November (around 44-45K.

each day) would be in-line with levels given that September. Translation:.

From a non-seasonally adjusted volume standpoint, car sales.

continue to plug along at a steady rate.” Sales need to continue to enhance, given the expected continual,.

but mild, advancement in total production and inventory levels,”.

stated Chris Hopson, principal analyst at S&P Global Mobility.

” However, we also continue to keep an eye on for signals of.

faster-than-expected growth in inventory. Currently, there are no.

clear signs; inventories have actually advanced as anticipated. However any.

indicator of faster than projected development in the total stock of.

brand-new lorries could imply that car customers are feeling the.

pressure of the present economic headwinds and retreating from the.

market.” As an outcome, Octobers SAAR boost is most likely to be an abnormality.

compared to the remainder of the year, Hopson stated, including that.

there are expectations of volatility in the regular monthly outcomes.

beginning in early 2023. Market share of battery-electric lorries is anticipated to reach.

5.9% in November. However, beyond the large seaside cities,.

retail registrations of EVs have yet to take hold, according to.

analysis from S&P Global Mobility.The top-eight EV markets in the United States are all in seaside states and.

represent 50.5% of overall EV registrations up until now in 2022 (through.

August). The higher Los Angeles and San Francisco cosmopolitan.

locations alone represent nearly one-third of overall share of the US.

EV market. The Heartland states market share of EV sales.

is barely half of what they add to overall automobile.

registrations.” BEV market share control on the 2 coasts is credited to.

their higher mix of early adopters compared to purchasers in middle.

America,” stated Tom Libby, associate director of Loyalty Solutions.

and Industry Analysis at S&P Global Mobility. “Their.

group profile is more in sync with the standard BEV buyer.

than the middle-American profile.” But Libby sees prospective for EV acceptance in leading heartland.

markets: “More approval and much wider customer awareness is.

leading to a natural development of adoption from the coasts to.

the Heartland.” (For more on this analysis of EVs in the Heartland,.

please see.

this unique report.) Supporting the EV improvement, product reveals surrounding the.

Los Angeles Auto Show last week continue to show the OEM.

focus.According to Stephanie Brinley, associate director of.

AutoIntelligence at S&P Global Mobility, “As car shows at.

their finest highlight what individuals will be driving in coming years,.

the reveals during the Los Angeles Auto Show reflect the continuing.

push toward electric and amazed cars.” Of note, Fiat revealed it will bring a variation of the European.

500 EV to the U.S. beginning in early 2024, reviving the 500e.

nameplate. Toyotas reveal of the 2023 Prius hybrid included a.

Prime cut that will double the hatchbacks EV-only variety, while.

the automaker also showed a rendering of the bZ (” Beyond Zero”).

electric-vehicle principle, previewing an upcoming compact SUV.

Vietnamese entrant VinFast showed U.S.-trim variations of.

two EV crossover additions to its lineup – bringing its potential.

United States offerings to 4.

This short article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled department of S&P Global.

Leave a reply