S&P Global Mobility: November auto sales continue previous three-month trend

Continuous financial headwinds mean no news could be excellent news

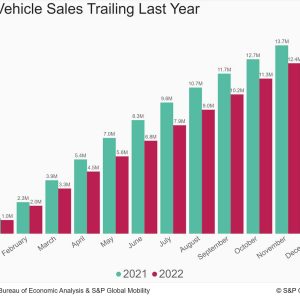

relating to vehicle need levelsWith volume for the month predicted at 1.122 million units,

November U.S. auto sales are approximated to translate to an approximated

sales speed of 14.1 million units (seasonally adjusted yearly rate:

SAAR). This would represent a sustained improvement from the May

through September period however will reflect a decrease from Octobers.

14.9 million-unit pace, according to S&P Global Mobility.

analysis.The everyday selling rate metric in November (approximately 44-45K.

per day) would be in-line with levels given that September. Translation:.

From a non-seasonally adjusted volume standpoint, automobile sales.

continue to plug along at a stable pace.” Sales ought to continue to enhance, provided the expected continual,.

however mild, improvement in overall production and inventory levels,”.

said Chris Hopson, principal analyst at S&P Global Mobility.

” However, we also continue to monitor for signals of.

faster-than-expected growth in inventory. Presently, there are no.

clear indications; stocks have actually advanced as anticipated. Any.

indication of faster than forecasted growth in the overall stock of.

new lorries could imply that auto consumers are feeling the.

pressure of the existing financial headwinds and pulling away from the.

market.” As a result, Octobers SAAR boost is likely to be an anomaly.

compared to the rest of the year, Hopson said, including that.

there are expectations of volatility in the month-to-month outcomes.

beginning in early 2023. Market share of battery-electric vehicles is anticipated to reach.

5.9% in November. Outside of the big coastal cities,.

retail registrations of EVs have yet to take hold, according to.

analysis from S&P Global Mobility.The top-eight EV markets in the US are all in coastal states and.

represent 50.5% of overall EV registrations so far in 2022 (through.

August). The higher Los Angeles and San Francisco metropolitan.

areas alone represent nearly one-third of overall share of the United States.

EV market. The Heartland states market share of EV sales.

is hardly half of what they add to general car.

registrations.” BEV market share control on the two coasts is attributed to.

their higher mix of early adopters compared to buyers in middle.

America,” stated Tom Libby, associate director of Loyalty Solutions.

and Industry Analysis at S&P Global Mobility. “Their.

demographic profile is more in sync with the traditional BEV purchaser.

than the middle-American profile.” But Libby sees prospective for EV approval in top heartland.

markets: “More approval and much wider consumer awareness is.

resulting in a natural progression of adoption from the coasts to.

the Heartland.” (For more on this analysis of EVs in the Heartland,.

please see.

this unique report.) Supporting the EV advancement, item exposes surrounding the.

Los Angeles Auto Show recently continue to show the OEM.

focus.According to Stephanie Brinley, associate director of.

AutoIntelligence at S&P Global Mobility, “As car programs at.

their finest emphasize what people will be driving in coming years,.

the reveals during the Los Angeles Auto Show reflect the continuing.

push toward electric and electrified cars.” Of note, Fiat revealed it will bring a version of the European.

500 EV to the U.S. beginning in early 2024, reviving the 500e.

nameplate. Toyotas reveal of the 2023 Prius hybrid consisted of a.

Prime cut that will double the hatchbacks EV-only variety, while.

the car manufacturer likewise revealed a making of the bZ (” Beyond Zero”).

electric-vehicle idea, previewing a forthcoming compact SUV.

Vietnamese entrant VinFast showed U.S.-trim versions of.

two EV crossover additions to its lineup – bringing its capacity.

United States offerings to four.

This short article was published by S&P Global Mobility and not by S&P Global Ratings, which is an individually handled division of S&P Global.

Leave a reply