A reckoning for EV battery raw materials

Geopolitical turbulence and the fragile and unpredictable nature of

the vital raw-material supply chain could curtail planned

expansion in battery production– slowing mainstream

electric-vehicle (EV) adoption and the transition to an amazed

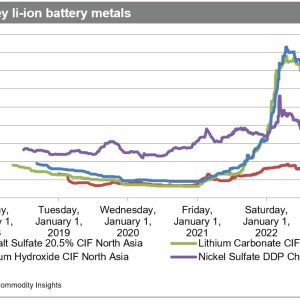

future.Soaring rates of important battery metals, as observed in the

following chart from S&P Global Commodity Insights, are

threatening supplier and OEM profit margins. This circumstance has

rapidly equated into increased part and lorry costs,

according to brand-new analysis from S&P Global Mobility Auto Supply

Chain & & Technology Group.Trade friction and ESG concerns are likewise impacting the

advancement of the raw materials supply chain in between markets.

These cumulative advancements include to the obstacles of the electric

vehicle transition.Achieving its volume goals will need a high growth curve for

a growing market. For OEMs to strike their BEV and hybrid sales

goals, S&P Global Mobility forecasts market demand of

about 3.4 Terawatt hours (TWh) of lithium-ion batteries, annually,

by 2030. This figure excludes the medium- and durable, and

micro-mobility spaces, along with customer electronic devices and

blossoming demand for fixed energy storage. The 2021 output

for the car industry: 0.29 TWh.Elements such as lithium, nickel, and cobalt do not simply

amazingly appear and transform into EV batteries and other

elements. The advancement chain is lengthy and complicated, from

their problem to extract to their complicated refining. The

intermediate actions between excavation and last assembly are a.

specific choke point in regards to know-how and market presence.

Currently, China is the clear leader in materials refining.

as the packaging and assembly of battery cells. At concern is which.

other countries will step up to facilitate this market.

transformation.In terms of accessing battery raw products, the equation boils.

down to: Who requires what, where will it come from, who will supply.

it, and who is best placed to take advantage of this increased.

dependence on a handful of important elements?The latest S&P Global Mobility research study assesses the.

battery raw material supply chain from extraction to car,.

determining: A variety of unknown companies will play a major function in the.

processing and development of battery-electric lorry (BEV).

technology that will underpin the light passenger lorries of the.

coming years and beyond; Potential trade friction might represent troubles for significant.

automobile companies in liberating themselves from an established,.

active, and affordable supply of processed materials coming.

from or via mainland China; Some OEMs are looking for the worth and reassurance of “locked in”.

supply chain relationships straddling my own to vehicle, minimizing.

the dependence on unpredictable area markets and/or a requirement to deal with.

less recognized industry partners.The process circulation listed below determines a well-understood and.

well-documented supply chain to supply the required nickel and.

lithium for Teslas NCA-based cylindrical cells produced in its.

” Gigafactory” near Sparks, Nevada, US.Now theorize that throughout the whole vehicle industry– and.

broaden EV market share to incorporate the bullish forecasts made.

for 2030 and beyond.The greatest quantity of nickel required by any given automobile.

brand for 2030 production is forecast to be Tesla– considered to be.

some 139,000 metric lots (mT). In evaluating the existing.

structure of their more comprehensive manufacturing bases, we anticipate each of.

Volkswagen, General Motors, and Stellantis to exceed this.

requisition quantity. Establishing modular battery loads that can be.

configured to fit multiple vehicle sectors and can accommodate a.

variety of battery chemistry options will ensure a degree of.

resiliency against raw product supply restraints and rate.

fluctuations.” We have determined a total of 28 extraction sources of.

battery-grade nickel over the coming 12 years to serve the light.

passenger-vehicle market, located in 15 nations worldwide,” said.

Dr Richard Kim, Associate Director with S&P Global Mobilitys.

Supply Chain & & innovation group. “However, the supply base for.

the upstream material processing actions and development of the.

basic battery cell cathode chemistries presents a challenging.

absence of geographic variety.” S&P Global Mobility research study suggests that, while the.

procedure of either smelting or high-pressure acid leaching (HPAL) is.

typically done at the nickel extraction website, that is not the case.

for the process of conversion to nickel sulphate.Of the 16 business that can perform this procedure at present, 11.

are in mainland China. By 2030 we anticipate the number of companies to.

increase to at least 24, of which 14 will likely be in mainland.

China. We anticipate mainland China to process 824,000 mT of nickel.

sulphate each year by 2030, with Chinese mining giant GEMs supply.

of nickel sulphate to essential Tesla provider CATL anticipated to be the.

largest supply contract by tonnage. By contrast, we anticipate North.

America and Europe to process just 146,000 mT.We needs to likewise consider threat in computing access to cobalt– a.

material well understood for its restricted sources of origin and.

issues concerning ethical supply. Battery-grade cobalt bound for.

energized light traveler automobiles currently originate from just.

18 mines, amounting to 52,000 mT – of which 29,000 mT is forecast to.

be mined in the Democratic Republic of Congo (DRC) in 2022. The.

United Nations has actually mentioned the DRCs “weakening security.

situation,” its humanitarian crisis affecting 27 million people, as.

well as child-labor practices and the continuous guerrilla project.

being waged over the exploitation of resources and food.

security.Despite the disputes damaging the DRC, we still approximate that.

nations output bound for OEMs and providers to increase to 37,000.

mT by 2030. Dependence on the DRC will reduce from 56% to.

17% in regards to overall tonnage. We expect near tenfold boosts in.

supply from countries such as Australia and Indonesia, while.

countries such as Vietnam, Finland, and Morocco will already weigh.

in with significant contributions. Given the dynamics of the supply.

market, even for an OEM with locked-in cobalt contracts with.

miners, a portion of several automakers supply stays unidentified at.

this phase.” Geopolitics has coupled with a desire for supply chain.

dominance and independence in the battery raw product supply chain.

advancement to date,” stated Dr Kim. “China has established a firm head.

start. The evolution of their Belt and Road effort plainly had.

one eye on the automotive industry shift to electrification,.

with broad tactical and logistical financial investments in Africa as well.

as Southeast Asia.” S&P Global Mobility research study plainly shows that.

developed battery basic material supply and processing operations.

under mainland Chinese ownership will continue to provide much of.

the worlds supply of lithium-ion batteries and their constituent.

essential elements.However, the imposition of nationalistic policies such as the.

United States Inflation Reduction Act (and the automotive.

implications of it) aim to belatedly redress some of this.

imbalance by promoting the setup of domestic supply chains, in.

return for financially rewarding aids to both the providers and the.

purchasing consumers.The battery will be the specifying technological and supply chain.

battleground for the market in the next decade, and access to.

their constituent basic materials will be important. S&P Global.

Movement will continue to evaluate the changing landscape of the.

battery raw products market in genuine time, including the current.

industry developments and research.Please contact automotive@spglobal.com.

to discover out more details around our insights to assist you make.

data-driven choices with conviction.

This article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled division of S&P Global.

Posted 31 October 2022 by Graham Evans, Director, Auto Supply Chain & & Technology, S&P Global Mobility.

Leave a reply