RAV4 Challenges F Series for Retail Sales Leadership

Any discussion about the most popular automobiles in the US has to

include the Toyota RAV4. Considering that January 2019, this compact utility

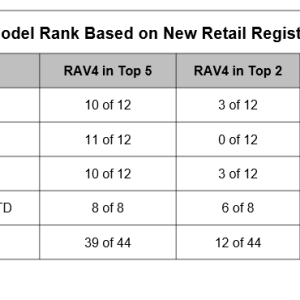

has ranked amongst the 5 most popular vehicles in the nation for

thirty-nine out of forty-four months (see summary listed below).

the RAV4 ranked 2nd in retail registrations in 11 of those 44

months, and first this past February.It therefore is not unexpected that in August 2022, the most

current month for which brand-new retail registration data are available,

more retail clients selected the RAV4 than for any other design

other than the Ford F Series pickup, and the gap between the 2 was a.

mere 230 units.RAV4 has several strengths. One is its durability in the market:.

RAV4 launched in the United States in 1996, earlier than any other in-market.

compact car-based crossover except the Kia Sportage, which arrived.

a year previously. (Honda CR-V and Subaru Forester concerned market in.

1997.) And while the RAV4 clearly has actually gone through various.

enhancements and re-designs, it has passed the same name.

throughout its 26-year history, making desired model-level equity.

with US consumers. In truth, 31% of RAV4 families obtain another.

one, above industry-wide design loyalty of 25% in the very first eight.

months of 2022. The compact energy also benefits from being part of a strong.

brand – 57% of Toyota owners who have actually returned to market so far in.

2022 obtained another Toyota, the highest brand commitment in the.

mainstream market after Ford; this obviously offers an abundant.

source of sales for the RAV4.The RAV4 likewise draws in competitive owners at an outstanding rate.

Looking once again at the very first 8 months of 2022, RAV4s.

conquest/defection ratio of 1.04 not just shows a net inflow of.

consumers (for every 104 homes conquested by the RAV4 from.

other designs, 100 RAV4 households flaw to other designs), but it.

likewise exceeds Toyotas typical ratio of.88 and is second greatest.

among Toyota volume designs after the Tacoma. However, it is.

noteworthy that RAV4 has a hard time versus a number of rivals, with a.

ratio listed below 1.0 (net outflow) with Jeep Wrangler, Mazda CX-5, VW.

Tiguan, Sportage, and Hyundai Tucson, amongst others.Since car prices still rank high with numerous customers, it is.

pertinent that RAV4 actual regular monthly payments are really competitive.

Monthly payments for a new RAV4 with a 60-month (or higher) loan.

balanced $550 August 2022 CYTD, less than the typical Compact.

Utility Segment payment of $580 during the same period. RAV4s.

payment is the tenth least expensive amongst the 23 compact energies for.

which S&P Global Mobility has adequate monetary data, however.

still above the payments for such rivals as Forester, CX-5,.

Chevrolet Equinox, Ford Escape, Tucson and Tiguan. * RAV4 likewise takes advantage of a choice of powertrains, including both.

the conventional internal combustion engine as well as a hybrid.

gas/electric offering (Escape, CR-V, Tucson, Wrangler, Sportage,.

and Nissan Rogue also provide these 2 choices). RAV4s hybrid.

setup rate has been increasing and reached 58% in Q2 2022,.

surpassing 50% for the very first time (partly driven by the hybrids.

excellent combination of fuel effectiveness and performance). Importantly, a RAV4 hybrid buyer will pay simply $39 more a month.

( with a 60+ month loan) than a RAV4 gas customer ($ 569 vs.

$ 530), but the hybrid buyer now has an “electrified” automobile, extremely.

much in style nowadays. In contrast, if the customer obtained the.

Toyota BZ4X, the electrical equivalent to the RAV4, his regular monthly.

payment of $810 would be $280 above the gas monthly.

payment.RAV4 hybrids likewise bring an indirect advantage to the Toyota brand.

Industry-wide, when a hybrid home returns to market, about.

13.4% will move to an electric vehicle; in contrast, when a.

gas family acquires a new car, only 4% will migrate to.

an EV (see chart below). In this sense, the hybrid works as a.

bridge to a fully electrical car, the last location of the.

whole US auto industry.Note: S&P Global Mobility commitment data cited in this.

report are derived from the Household Methodology, in which the.

recently obtained car is not always a replacement for the.

original vehicle but may be an addition to the family.

fleet.

—————————————————————————————————- Top 10 Industry Trends ReportThis vehicle insight belongs to our month-to-month Top 10.

Industry Trends Report. The report findings are drawn from.

used and new registration and commitment data.The October report is now available, integrating August 2022.

CFI and LAT data. To download the report, please click below.DOWNLOAD REPORT.

Posted 28 October 2022 by Tom Libby, Associate Director, Loyalty Solutions and Industry Analysis, S&P Global Mobility.

This post was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately handled department of S&P Global.

Leave a reply