S&P Global Mobility predicts strong monthly SAAR for October

This article was released by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

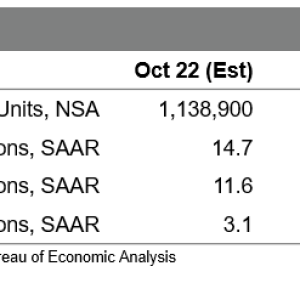

On predicted volume of approximately 1.139 million systems, US

auto sales in October will reach a seasonally adjusted yearly rate

( SAAR) of 14.7 million units, according to S&P Global Mobility

estimates. While this would mark the greatest monthly SAAR level

in eight months, the underlying characteristics of the market remain in

flux.” Pockets of vehicle stock levels continue to enhance

quicker than gotten out of extremely low levels and

bring welcome news on the supply side of the formula. Nevertheless,

vehicle customers are likely feeling the pressure of present economic

headwinds,” according to Chris Hopson, Principal Analyst at

S&P Global Mobility. “While we continue to point to

inventory levels as a significant aspect in stemming immediate-term

momentum in auto sales levels, the deteriorating financial

conditions are ending up being more prevalent.” Hindered by greater rate of interest settings and lower levels of

tasks development than formerly prepared for, consumers are expected to

retrench – thus ending up being a major input factor to automobile need

levels over the next 12-18 months. In its October 2022 United States Economics

upgrade, S&P Global Market Intelligence team has revised

downward its forecast of genuine GDP development in 2023 from 0.9% to

-0.5%. The base projection now includes a moderate recession beginning in

the 4th quarter of this year, with an anemic healing taking

keep in the 3rd quarter of next year.If theres a silver lining, the capacity for faster new-vehicle

stock development ought to permit downward pressure on car

pricing and supply some clearance for automobile customers willing to

test the market in 2023.

Leave a reply