October Forecast: As supply chain challenges ease, demand headwinds could impact global light vehicle production

This short article was released by S&P Global Mobility and not by S&P Global Ratings, which is an individually managed division of S&P Global.

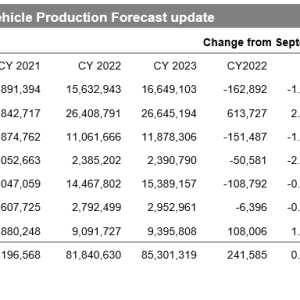

S&P Global Mobility experts have released the current international

light automobile production projection update, with additional reductions

throughout a number of areas offered ongoing supply chain challenges.As ongoing supply chain difficulties continue to slowly

improve, markets are progressively considering the harmful

forces of high inflation, increasing interest rates and the specter of

economic stagnation or outright contraction in essential markets such as

the US and West Europe pressing fragile bottled-up demand, according

to the current standard light lorry production forecast update

from S&P Global Mobility.While the instant near-term outlook is supported by continued

strong performance in Greater China and South Asia through the

balance of 2022, possibly more significant are the down

modifications for North America, Europe and other markets to show

the effects of increased need destruction.In the longer term, car pricing will stay a secret

factor to consider and a prospective headwind to demand, especially as

numerous markets shift to much greater levels of electrification, The October 2022 forecast update reflects near-term upgrades for

Greater China on the strength of need stimulus and South Asia as

the area take advantage of a stabilized supply chain supporting

efforts to clear order stockpiles.” Greater China is rebounding highly since the lockdowns of

Q2 while OEMs in Europe and North America are still constrained by

difficulty in securing component materials,” said Mark

Fulthorpe, executive director, light car production forecasting

at S&P Global Mobility.However, perhaps more crucial are the near-to-intermediate

term down revisions particularly focused on Europe, North

America and Japan and eventually other regions.While semiconductor availability remains an essential

consideration, need destruction is expected to play a more

essential role and speed up in 2023 in a number of key markets,

affecting production through the intermediate term and the

magnitude/need for stock restocking.

Leave a reply